The 260,000 pension savers who took a taxable pension payment in 2020 brings to 1.6 million the number subject to these stringent tax rules in the five years since they were introduced.

Most people taking a taxable flexible payment from their pension do not use the free, impartial and independent Pension Wise guidance service created to help inform them of their options and alert them of potential pitfalls.

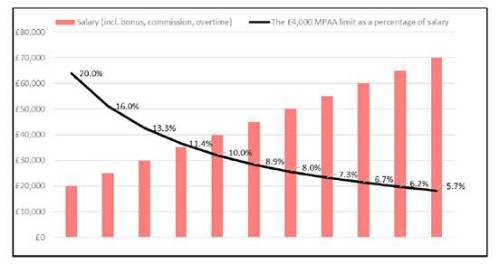

It is important for pension savers to understand the MPAA because it restricts how much they can save into a defined contribution pension while still receiving tax relief to £4,000 a year, from £40,000 previously.

That can severely reduce people’s future contributions, for example, if they are medium to high earners who are members of a company scheme, or if they have taken a flexible lump sum early, planning to make it up later. The MPAA rules also require savers to notify any other scheme they pay into that they are subject to restrictions.

Stephen Lowe, group communications director at retirement specialist Just Group, said he was concerned that too few people taking their first flexible payment had taken the expert guidance designed to help them avoid unwittingly falling into tax traps like the MPAA.

“Taking tax-free cash from a pension is relatively straightforward but taking taxable income from a pension creates much more complexity,” he said. “The idea that you have the freedom to use your pension like a bank account – paying in or drawing out when you want without any knock-on consequence – is simply not how the system works.

“The first taxable withdrawal can trigger an overpayment of tax that will need to be reclaimed – the government has had to pay back more than £692 million to pension savers who have overpaid tax on flexible withdrawals since 20152.

"On top of that, the MPAA rules kick-in, slashing the amount savers can add to their defined contribution pension while still benefiting from tax relief to less than £72 a week which can cause problems for people who had planned to top-up their pension savings in the run-up to retirement, perhaps when the mortgage was paid off and kids had left home.”

“Taking a flexible payment is fine if you understand the rules and it is part of your financial plan,” he said. “But many people will not have pored over the small print of the tax rules or understand the extra administrative responsibilities,” said Stephen Lowe.

“Those who simply dipped into their pension to get them through a tough patch intending to make up their pension savings later could be in for a nasty surprise.

“This is just one example of why it’s essential the FCA takes strong action to ensure that as a starting point, the vast majority of pension savers receive the benefits of free, independent and impartial guidance offered by Pension Wise.”

Pension minister Guy Opperman said he wants taking guidance to be ‘the norm,’ for pension savers and the Financial Conduct Authority is looking at how to boost usage. Stephen Lowe said the current system is not working and the regulator needs to be bold, for example by automatically booking pension savers into guidance sessions from age 50 to ensure nobody misses out on the benefits even if they aren’t aware the service exists to help.

“Automatic enrolment into workplace pensions has dramatically increased the number of pension savers,” he said. “It is a logical step to stream those pension savers into guidance ahead of them becoming eligible to access their pension savings so they understand the pros and cons of each option. That is the best way to ensure they can make informed decisions now without regretting their choices later.”

|