This includes a move away from low-yielding gilt investments to higher-return, income-generating assets, and a different approach for potential life expectancy changes.

Raj Mody, global head of pensions at PwC, said: “In an unprecedented run, pension schemes have remained out of deficit for over 12 months. Despite inflation hitting a 30-year high, it’s likely that the surplus trend will be sustained. The inflation situation may even generate a greater surplus. Although pension scheme benefits are linked to inflation, the increases are typically subject to a cap. In most schemes this cap is lower than the current rate of inflation, so scheme liabilities are not fully exposed to inflation volatility. This will give some protection to the funding health of most schemes, and potentially see even more surplus created as inflation tensions eventually subside.

“Running a pension scheme with significant surplus can cause challenges for trustees. Their powers are not always well designed to deal with such situations. There can be pressure to spend some of the surplus on improving member benefits, which might sound appealing for members, but can be difficult for trustees to act fairly between different categories of membership. Surpluses can also lead to investment and tax inefficiencies.”

Laura Treece, pensions actuary at PwC, added: “Many well-funded schemes are now on the brink of being able to take action to secure members’ benefits for good. But their sponsors are increasingly concerned about putting in more cash than is needed to do so. They know that if they overshoot the amount required it will be hard to get the excess back. In this new world of persistent surpluses, trustees and sponsors need to re-evaluate the best way of managing their schemes towards their long-term goals. Laura Treece, pensions actuary at PwC, added: “Many well-funded schemes are now on the brink of being able to take action to secure members’ benefits for good. But their sponsors are increasingly concerned about putting in more cash than is needed to do so. They know that if they overshoot the amount required it will be hard to get the excess back. In this new world of persistent surpluses, trustees and sponsors need to re-evaluate the best way of managing their schemes towards their long-term goals.

“Even if the ultimate target is some kind of insurance buy-out, instead of continuing to pay cash into an already well funded scheme, sponsors could pay this into a separate funding vehicle. This money can be used to support the pension scheme, but won’t be tied up if not all of it is needed. It would help avoid future stranded surplus, and the associated loss of value.”

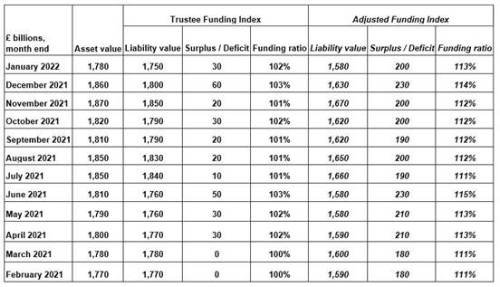

The Pension Trustee Funding Index and Adjusted Funding Index figures are as follows:

|