The average quoted Shoparound premium for an annual comprehensive car insurance policy now stands at £628.24, a fall 3.9% over the quarter and down 9.9% over 12 months.

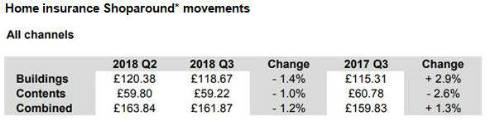

A typical home combined buildings and contents policy quote is now £161.87, down by 1.2% over the third quarter of 2018 but up 1.3% over 12 months.

Car insurance

Since its peak at the highest-ever level recorded by the British Insurance Premium Index, £733.47 at the end of the second quarter of 2017, premiums have continued their downward trend with an average quoted premium of £628.24, 3.9% down over the three months ending 30 September and 9.9% down over 12 months.

This is thanks, in part, to the expectation of potential savings that could be made in the wake of the Civil Liabilities Bill whiplash reforms and is also reflected in Office for National Statistics inflation data*.

The AA’s director of insurance, Janet Connor, says: “A significant fall in the cost of car insurance is welcome news for drivers and, the average premium quote is now more than £69 cheaper than a year ago.

“But there are several uncertainties on the horizon. The Civil Liabilities Bill has been delayed and there is concern that some of the measures included in the Bill may be watered down. Similarly, the Government’s commitment to revise the so-called ‘Ogden’ or discount rate on injury payments has also been delayed, but is expected during the first quarter of 2019.

“In addition, Brexit concerns and the value of sterling have seen the cost of imported car parts, vital for the car repair industry, rise.”

However, Connor points out that the biggest uncertainty is with Insurance Premium Tax (IPT) which has doubled to 12% in the last two years.

She says: “The Government has already committed to continue the fuel duty freeze which could put pressure on the Chancellor to increase IPT in his 29 October Budget.

“I strongly urge him to resist this ‘raid on the responsible’ that penalises both drivers who have no choice but to pay for insurance if they are to drive legally; and home owners seeking to protect their property.

“It’s young drivers who take the brunt of this underhand tax because they pay the highest premiums. It’s no coincidence that the number of people caught driving without insurance goes up after each increase in IPT.

“While the Justice Secretary is seeking to reduce insurance premiums by stemming the excesses of claims management cold-callers, I’m concerned that the Chancellor is bent on taking it away by increasing the tax on premiums.”

NOTE: TPFT appears to be more costly than comprehensive because it reflects the type of driver most likely to buy such cover: ie young drivers in generally older cars

Home insurance

The cost of insuring a home remains remarkable value for money as the average Shoparound quote for both buildings and contents cover has fallen over the past quarter, as has the cost of a typical combined policy.

• The average buildings premium fell by 1.4% (or £1.71) to £118.67 but has risen by 2.9% over 12 months.

• The average contents premium fell by 1.0% (or just 58p) to £59.22, and down by 2.6% over 12 months

• The average combined policy quote fell by 1.2% (or £1.97) to £161.87, but up by 1.3% over 12 months.

Janet Connor, director of AA Insurance says: “Home insurance has become increasingly competitive as more people shop around for the best quote.

“Buildings premiums have been climbing since 2016 largely in response to the growing risk of storm and flood damage although 2018 has seen relatively few such claims since last winter. However, the low rainfall over a long hot summer is leading to concern among some commentators that there may be a rise in subsidence claims over coming months.

“Contents premiums on the other hand, have remained relatively steady and are only about £1 more than the average Shoparound quote when the AA’s Index was launched back in 1994.

“Improved home security has led to fewer burglary claims. According to the Office for National Statistics**, households are now four times less likely to be a victim of burglary than in 1995, having fallen fastest since 2011 when home contents premiums peaked at £72. However, ‘escape of water’ (such as burst pipes) remains the top reason to make a home contents claim.”

|