Moaning about LISA?

Following a consultation exercise, many expected the then Chancellor would announce a widespread reform of pension tax relief in his April 2016 Budget, but in the end he did not go ahead with such a radical change and instead announced the launch from next April of a Lifetime ISA targeted on the ‘young’ aged between 18 and 40. Savings into a LISA would be from after-tax income up to a maximum of £4,000 per year with a 25% bonus on savings made before age 50.

However, after age 60 all savings can be taken tax-free. A Government message, amongst others, is (to quote) ‘use it to save for retirement’.

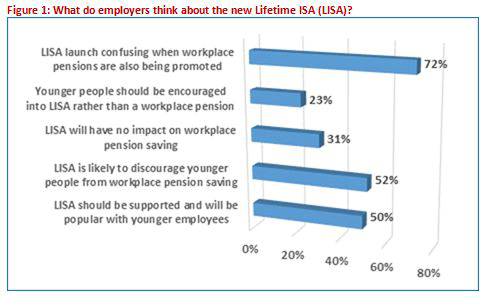

The ACA survey found that 72% of firms are confused by the launch of the Lifetime ISA (LISA) next year given the Government’s parallel initiative of requiring all small firms with 1 or more employees to also auto-enrol employees into separate qualifying pension arrangements (see Figure 1, below).

Other findings on LISA echo the confused message from Government, with firms going in different directions about whether LISAs should be encouraged or not and what impact their introduction is likely to have on pension take-up.

ACA Chairman, Bob Scott, commented: “Initiatives to encourage saving generally are to be welcomed, but incentives need be viewed in a holistic way so that longer-term saving attracts greater support and so that one product does not compete or conflict with another. Whilst LISAs may not initially discourage younger employees from opting-out from auto-enrolment pensions whilst minimum employee contributions are below 1% of earnings, there must be a real query over whether this will remain the case when minimum employee contributions climb to over 3% of earnings in 2019 – and possibly higher levels in years to come.

“Aside from the reliability of a tax-free promise made now, which cannot commit a future Chancellor in years to come, we think the present Chancellor would be wise to pause and examine carefully with DWP colleagues just how LISAs might fit alongside encouraging greater saving in auto-enrolled pensions before fixing on what now looks to be a premature launch.”

And what about pension tax reform?

The wider pension tax reform many expected last year was not forthcoming, but certainly more changes were not totally ruled out. Might the Autumn Statement or the April 2017 Budget take this up again? To date, there have been few pointers from the new Chancellor, Philip Hammond, but if he is tempted to make further changes, our survey points to the measure that would be most popular amongst smaller employers.

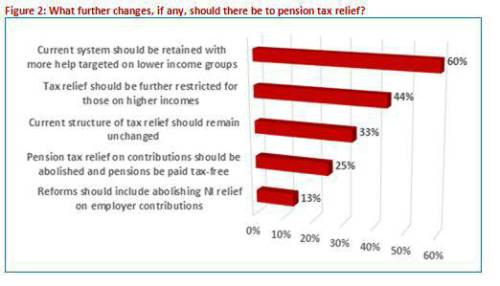

60% of firms say they want the current system of tax retained but with more help targeted on lower income groups, which – inevitably – if costs are to be constrained means further reductions in relief at the top income levels with more relief at lower incomes, perhaps a flat rate relief up to a capped annual amount. Whilst 25% of firms support a pension ISA-type model, where savings are taxed with the pension paid tax-free, just 13% would support a change whereby NI relief on employer pension contributions are abolished (see Figure 2, below).

The ACA has been supportive of a thorough reform of pension taxation and has been concerned at the mounting complexity associated with the regular tightening of reliefs that has taken place under the last two Chancellors as they have endeavoured to rein back on costs. The Lifetime Allowance has caused both employers and an increasing number of individuals’ huge problems in terms of administration and certainty of accurate calculation of the tax due. It is one element in the current system that needs to be dispensed with as soon as is feasible. An argument can clearly be made for targeting what relief is available on lower income groups and this would seem to chime with the new Prime Minister’s comments on taking office.

ACA Chairman, Bob Scott, commented: "Wholesale reform of pensions tax is long overdue - the more tinkering the government does the more that individuals and their employers lose confidence in pensions.

“It is clear from our survey that smaller employers favour both restricting tax relief for higher earners and targeting more help on lower income groups. The Chancellor should have that aim at the front of his mind and, we suggest, he should avoid the temptation of measures that are designed to raise tax revenue by restricting the overall level of relief available."

|