Recent ONS surveys have shown that the number of those staying on at work past the State Pension Age (SPA) has been climbing at some pace. This has been explained largely by the financial pressures on those approaching retirement, not least because of much reduced income from private savings and annuities in a low-interest rate environment.

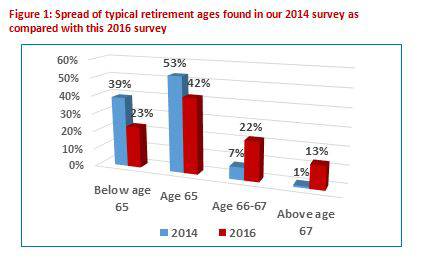

This year’s survey found a significant shift in the percentage of firms where employees are typically retiring at age 66 or above - 35% as opposed to just 8% two years ago (see Figure 1, below), with the change most marked amongst firms employing fewer than 50 employees.

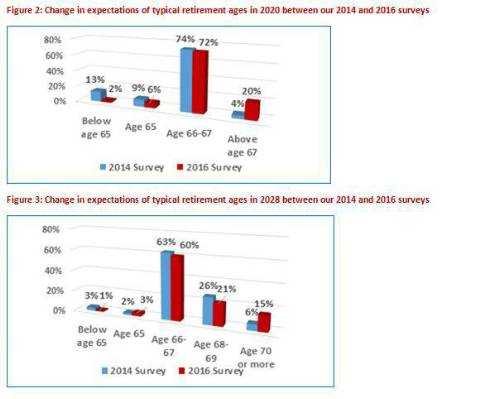

Looking ahead, there has also been a big shift over the last two years in firms’ forecasts of typical retirement ages in their businesses as SPA increases over the next decade or so. The changes suggest many employers expect that typical retirement ages in the smaller firms’ sector will out-pace the increases in SPA.

Whereas two years ago, just 4% of firms expected typical retirement ages to rise to above age 67 by 2020 (by when SPA increases to age 66), five times as many - 20% of firms - now expect typical retirement ages to rise to above age 67 by then. And, looking further ahead, when SPA rises in 2028 to age 67, some 36% expect typical retirement ages to be a pace ahead at age 68 or above (see Figures 2 and 3, below). Again, it is employers with fewer than 50 employees who expect the biggest leaps in typical retirement ages. This is likely to be related to the lower earnings prevalent in smaller firms – for example, 42% of employees in micro-employers (1-4 employees) earn less than £10,000pa.

These findings suggest that small firms are expecting more employees to want to work on beyond current retirement ages with the pace of change in ‘working-on’ moving more quickly than the increases in SPA. This should mean an increasing number of older employees will be receiving both a wage and/or salary whilst also being in receipt of their State pension (unless they defer). Whilst this could mean more of this group have a comfortable financial position than those in the same age group today, continued low annuity and savings rates may offset this hope. Whilst some studies have disputed the impact, a sharp and persistent rise in older employees continuing to work must at some stage have an impact on employment and career opportunities for younger people (where, for example, currently over 11% of those aged 18-24 are unemployed).

Commenting on these findings, ACA Chairman, Bob Scott added: “Improving life-spans are clearly a boon, but they have placed considerable strains on the pension system and employers; and stretched many individuals’ personal finances over the last few years. Our findings suggest smaller firms are increasingly looking to retain, or are expecting to have to retain, many more employees beyond State Pension Age, potentially boosting the incomes of this group.

“However, conversely, the relative rapidity of change is likely to further exacerbate the intergenerational challenges that are increasingly being highlighted in the media and beyond.

“And one area of tension may well be with public sector employments, where those often protected by more generous ongoing defined benefit schemes, largely financed by private sector employees and employers through taxes, may be able to retire at relatively much lower ages than those working for the small firms covered by this survey.”

The upcoming review of State Pension Age

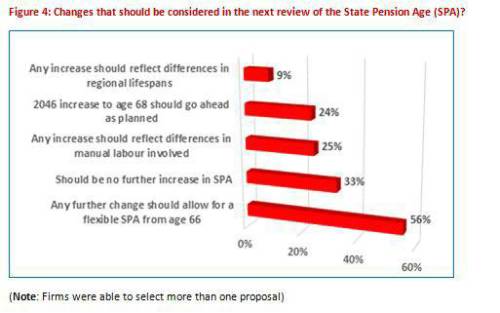

The Government has begun to consider future moves in the State Pension Age (SPA) and is seeking views at present on possible options with a view to making an announcement May 2017 on the path ahead. The review will not only encompass projections of life-span changes over the period ahead, but also wider social considerations as evidenced by the interim report of the Cridland review.

This year’s survey explored some of the changes that should be considered in the review. By far the most popular call was for any further change to allow for a flexible SPA from age 66, which is supported by more than half of the survey’s respondents. This was clearly judged to be a more acceptable proposal than outcomes where the SPA might be lower for those in manual occupations or a solution that in some way reflects regional disparities in life-spans (see Figure 4, below). That said, despite extending life-spans, a third of firms wanted the review to result in no further increases in SPA and a quarter felt an increase to age 68 should not take place until the planned date of 2046.

An option for individuals to have some flexibility to draw their State Pension from an earlier age than State Pension Age, as life-spans extend, would help those who feel less able to continue to work beyond that age for a range of reasons. It would seem a sensible compromise and overcome the unfathomable ways that might have to be dreamt up to test who might qualify for a lower SPA as a ‘manual’ employee or by way of regional deprivation (would this apply to all post codes in a region – rich or poor – and how would the government prevent people gaming the system by switching to occupations/addresses that provided an entitlement to a lower SPA?).

A Final Report on the 2016 survey’s full findings is due to be published early in the New Year.

|