Move to CPI with caveats

The survey, which is conducted every two years, covers firms with fewer than 250 employers, where over 84% of defined benefit schemes reporting to the survey say they are closed to new members and 57% are also closed to future accrual.

However, the compulsory indexation of benefits – required by law from the late 1990s – adds considerably to ongoing pension costs, often reducing monies available for funding defined contribution pensions for most existing employees.

Whilst some schemes have moved from RPI to CPI indexation of benefits, many have found their scheme rules too complex to progress such a change or the process too costly to enact.

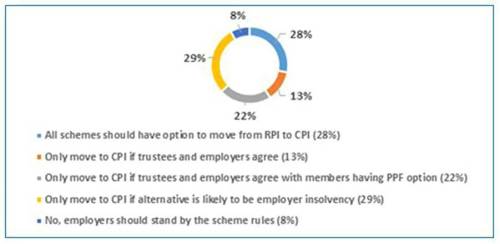

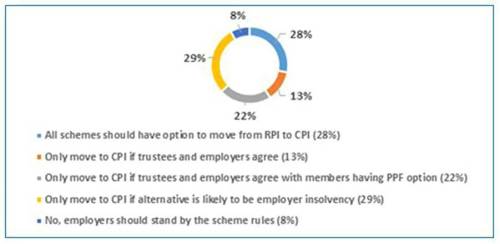

The survey found 92% favoured a change in the law to allow the move to CPI, albeit many wanted this to be subject to the agreement of trustees or, only if otherwise, the employer was likely to declare its insolvency (see Figure 1, below).

Figure 1: Should the Government change the law so that pension schemes can reduce pension increases if continuing to provide increases at the level in scheme rules will severely and adversely affect the employer?

In recent evidence to the House of Commons Work & Pensions Select Committee Inquiry into defined benefit regulation, the ACA has said providing a statutory override to scheme rules that would enable trustees and employers, with schemes that link increases and revaluation to the RPI, to move to the statutory rates (currently linked to CPI) would be helpful. Indeed, by freeing up company resources, this could result in better outcomes for money purchase members.

ACA Chairman, Bob Scott, commented: “We do not make this suggestion lightly, but it is unlikely that scheme rules were ever intended to tie trustees to an index the National Statistician has described as flawed. It is also worth noting that compulsory indexation of pensions was introduced by the Pensions Act 1995 – many schemes provided increases on a discretionary basis prior to then – and so, we suggest that it would be appropriate for the Government to legislate to help address an issue that is largely due to the impact of previous legislation.”

The current regime means that current employees with no access to DB schemes (nearly all younger employees in the private sector) take all of the risk of pension provision, and on average will receive considerably lower pensions than previous generations of employees. In addition, the tax system makes it difficult for them to contribute sufficiently to match the benefits DB schemes provides, particularly where they succeed in their careers, or they have career breaks.

The ACA also notes that majority of DB schemes have or will soon close to future accrual. As companies have endeavoured both to keep up with changing pensions and tax legislation and to make their DB scheme affordable, many schemes have ended up with complex benefit structures with different accrual rates, retirement ages and pension increases applying to different periods of service. This leads to more expensive administration (which is more prone to error) and more confusion amongst members. Complex benefit scales are also unattractive to insurers when schemes are considering a buy-out.

In the light of this, the ACA has said that It would be helpful for the Government to also introduce a facility whereby schemes could convert historic benefit scales to a single simplified benefit structure – on the basis of fair value. Once schemes had converted in this way, it would be open for smaller schemes – over 2,000 schemes have fewer than 100 members – to merge with each other. Such consolidation would also lead to greater efficiency and cost savings.

|