This continues to buck the trend with the PPF 7800 index falling for the third month in a row, primarily due to its vulnerability to gilt yields, and is in sharp contrast to other pensions stories in the news.

For example, reports of an offer by Tata Steel to make a one off payment of £520m into its £15bn UK pension scheme – the British Steel Pension Scheme (BSPS) – have been criticised as not going far enough to plug its funding deficit nor sufficiently protecting the Pension Protection Fund, with suggestions that its funding deficit could increase to as much as £2bn at its 2017 actuarial valuation.

First Actuarial have estimated that using assumptions in line with those used for the FAB Index, the BSPS could easily have a surplus of £2bn calculated on a best-estimate basis. Whilst not necessarily suitable for funding purposes, it does demonstrate that more context needs to be given when reporting on the financial position of UK pension schemes.

First Actuarial Partner, Rob Hammond says: “Press attention continues to focus on the worst-case scenario for pension schemes, sensationalising pension scheme deficits, which does nothing to restore public confidence in pensions.

“This has led to overfunding of pension schemes by pension scheme trustees which is putting excessive pressure on employers, and a sharp increase in members wanting to transfer out of defined benefit pension schemes.

“The FAB Index provides an alternative way of looking at things, which provides trustees, employees and the general public alike, with a more rounded view of the state of their pension scheme, so that decisions can be made from a much more informed position.”

The technical bit…

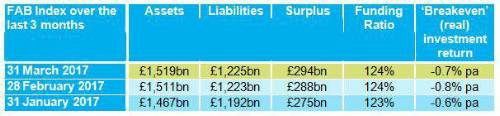

Over the month to 31 March 2017, the FAB Index improved with the UK’s 6,000 defined benefit (DB) pension schemes increasing their surplus from £288bn to £294bn.

The PPF 7800 index deficit decreased over March from £242.0bn to £226.5bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best-estimate basis – the so called ‘breakeven’ (real) investment return – has increased to inflation minus 0.7% pa. That is, a nominal rate of just 2.9% pa.

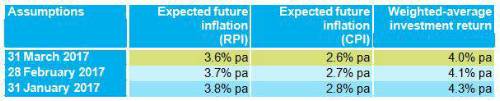

The assumptions underlying the FAB Index are shown below:

|