• Swiss Re's business unit Admin Re® agrees to acquire Guardian Financial Services for GBP 1.6 billion

• Acquisition will support Admin Re®'s ambition to emerge as a leading closed life book consolidator in the UK, with over four million policies

• Acquisition expected to significantly increase Admin Re®'s gross cash generation capacity and return on equity (ROE)

• Attractive opportunity to deploy part of excess capital above the Swiss Re Group’s profitability hurdle rate of 11% ROE; in line with the Group strategy

• Operational, capital and asset management synergies expected

Michel M. Liès, Swiss Re's Group Chief Executive Officer, says:

"This acquisition is an excellent opportunity for Admin Re® to further enlarge its successful business and diversify its portfolio. It is proof that we can deliver on our ambitions to seek profitable growth opportunities for Admin Re® in the UK. The expected returns exceed our profitability targets for new business and represent an excellent fit with our Group strategy as well as with Admin Re®'s capabilities and existing infrastructure."

Admin Re® and Guardian are both buyers and consolidators of blocks of in-force life and pension insurance business. With this acquisition of Guardian, Admin Re® will add 900 000 annuity, life insurance and pension policies in the UK and Ireland. This will bring the policy count of Admin Re®'s UK business to over four million and strengthen its established business.

David Cole, Swiss Re's Group Chief Financial Officer, says:

"This acquisition is in line with Admin Re®'s strategic goals as well as with our multi-year financial planning. We will continue to remain well capitalised and our economic solvency ratio will remain comfortably above our risk tolerance. This acquisition is also in line with the Swiss Re Group's capital management priorities and, accordingly, does not alter our view of the share buy-back programme, which was authorised by our shareholders at the 2015 Annual General Meeting. The transaction is of a scale that was already contemplated when we evaluated the scope of the share buy-back programme. The launch of the programme remains subject, as previously said, to the availability of excess capital, and any decision to launch it will also take into account other potential business opportunities meeting Swiss Re's strategic and financial objectives and major loss events."

The acquisition is an attractive opportunity for Swiss Re to deploy part of its excess capital above the Group’s hurdle rate of 11% ROE. Admin Re® is expected to generate around USD 1.7 billion of gross cash, including capital synergies, over the first three years. In addition, the assets under management of the Swiss Re Group will increase by GBP 12.5 billion, or approximately 15%. Under US GAAP accounting standards, the acquired business will be accretive to the Group's net income. Under Swiss Re's proprietary economic value management (EVM) framework, the acquisition is expected to result in an EVM loss of approximately USD 0.9 billion at inception. It is however expected to generate a positive contribution to EVM economic net worth over time, supporting Swiss Re's focus on long-term value generation.

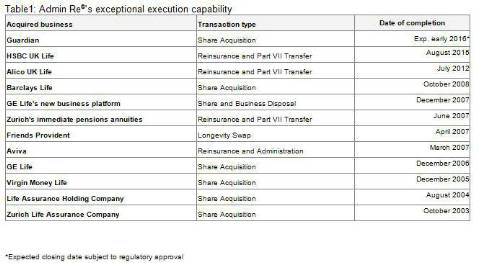

Bob Ratcliffe, CEO of Admin Re®, says: "We're very proud to be taking on Guardian's policyholders and staff delivering the same seamless service that we bring to our current 3.4 million customers. Admin Re® has an expert team and the infrastructure in place to ensure we can bring the benefits of scale that make a closed life book consolidator successful. Admin Re® has a long track record of migrating life portfolios and maintaining a high level of customer service for policyholders. We expect that after this acquisition, we will continue to seek growth via other acquisition opportunities, developing further our leading consolidation franchise."

The acquisition will be financed from cash on the balance sheet as well as debt financing. Swiss Re believes that significant growth opportunities are still available as vendors seek to refocus on new products and release capital from legacy books.

|