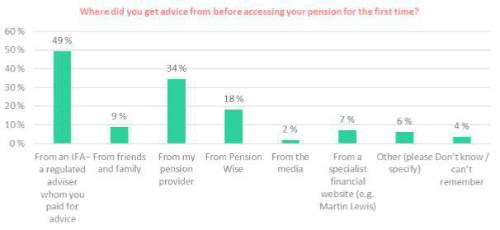

Of those aged 55+ who had accessed a pension and said they received advice, fewer than half (49%) said they paid for it from a regulated financial adviser. A third (34%) said the advice came from their own pension provider. Nearly one in five (18%) said they were advised by Pension Wise, the free, independent and impartial guidance service which does not offer regulated advice. Other sources of advice were friends and family (9%), a specialist financial website (7%) and the media (4%).

“Overall, we found fewer than half of those who had taken cash from their pension said they received advice and, of those who said they did, many were clearly confused about what advice is,” said Stephen Lowe, group communications director at Just Group.

“Misconceptions are rife, ranging from using Pension Wise to seeing articles in the newspapers or talking to friends or family.

“People are obviously trying to make good decisions but many are missing out on the free, independent and impartial support they are entitled to.”

He said that too few were benefitting from the government’s ‘guidance guarantee’, which was introduced alongside ‘freedom and choice’ in 2015. Designed to help equip people with the knowledge of how the retirement market works, it also helps them understand the difference between information, guidance, and advice.

“Ensuring everyone gets the benefit of impartial, free guidance unless they make an active decision to opt out is the job given to the Financial Conduct Authority by government,” said Stephen Lowe. “Guidance has been proven to boost users’ confidence in making the decisions they face and their ability to spot scams.

“Put simply, too few are receiving the support they have been promised and given the clear confusion among savers about what advice or guidance looks like, the FCA has an urgent job to do.

“Our research found only one in 25 would opt out if an impartial guidance session was pre-booked for them. This approach would deliver a meaningful boost to the low one in six who currently make use of a guidance session – and would be especially helpful for groups with lower financial capability and less confidence to engage in pension decisions who are currently at greater risk of missing out.”

|