-

1.5m employees do not know their pension fund choices or have never reviewed them

-

Almost one in five employees at small businesses are neglecting their pension savings with more SMEs set for auto-enrolment in 2016

-

Not being able to afford contributions the leading cause of employees opting out

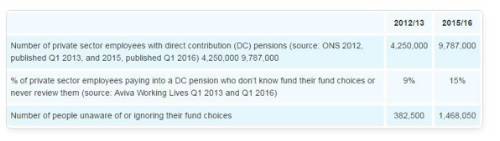

Since the introduction of auto-enrolment over three years ago, the number of pension savers who are unaware of their fund choices or have never reviewed them has risen to almost 1.5 million people - 15% of private sector employees, up from 9% back at the start of 2013.

The figure rises even higher for employees at small businesses with almost one in five (19%) indicating they are not aware of their fund choices. There is also potential for these levels to rise further over the course of 2016 amongst small business employees, with 480,000 small and medium sized enterprises beginning their auto-enrolment journey this year.

The findings also highlight that even fewer employees are seeking financial advice before reviewing any investment choices, with only 4% admitting they do so, compared to 7% three years ago.

The total number of private sector employees now enrolled with a DC workplace pension stands at close to 9.8million and the introduction of auto-enrolment has been widely welcomed. Almost three quarters (74%) of employers who have begun auto-enrolment approve of making the workplace the focus for pensions savings, while an overwhelming 93% of employees say the process has been straightforward.

Affordability a common factor as to why employees avoid a workplace pension

It is estimated however that 10% of automatically enrolled employees have chosen to opt-out of their workplace pension². Aviva’s research highlighted not being able to afford contributions as the most common factor as to why employees currently choose not to pay into any company pension they have been offered, with 32% of employees citing financial constraints, although this was lower than in 2013.

There has also been an increase in the number of people turning down the opportunity to pay in to a workplace pension because they think it is too late to start saving, rising from 15% in 2013 to almost a quarter (24%) in 2016. Worryingly, 13% of employees aged between 25-34 are among those who think that it is too late to start saving.

A growing number of people are also opting not to contribute because they would rather have cash to fund their lifestyle, up from 15% in 2013 to 19% in 2016.

Communication from employers on auto-enrolment

When it comes to understanding how auto-enrolment works, one in five (20%) private sector employees disagreed that their employer has explained auto-enrolment in a way that they can understand – a rise of 8 percentage points from the 12% of employees who disagreed in 2013.

In terms of who is responsible for encouraging employees to join a workplace pension scheme, close to half of employers (47%) believe it to be their responsibility. However this falls to only 33% amongst small businesses.

Andy Curran, Managing Director, Corporate & Business Solutions at Aviva, said: “Auto-enrolment has transformed the savings landscape for millions of private sector employees and considerable momentum has been built to date. It is clear there has been substantial support and businesses of all sizes should be proud of how well received the changes have been.

“That said, the Working Lives findings highlight that we cannot be complacent and that the auto-enrolment journey does not end once employees start contributing. It is vital employees engage with the processes behind their pension. We must continue to make every effort to ensure people have all the support they need to make the most of their pension provision.”

¹ONS - Annual Survey of Hours and Earnings and Earnings Pension Tables: 2015 Provisional and 2014 Revised Results

²Department for Work & Pensions – Automatic Enrolment evaluation report 2015

|