The new range responds to pension freedoms and changing investor behaviour, providing options for how investment risk is managed in the run-up to retirement.

At the heart of the range are five funds which use Aegon’s new Flexible Target glidepath, designed to keep investors’ options open as they near retirement. This approach aims to reduce risk while maintaining diversification in the final six years before retirement. The aim is to cushion retiring investors from the worst consequences of a market fall and retain some growth potential.

Three ways to prepare savings for retirement

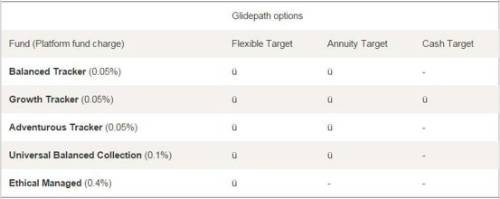

All the Workplace Target funds use a two stage investment strategy that’s designed to grow savings in the early years (the growth stage), then prepare savings for retirement in the final six years of saving (the retirement target stage). The range offers three retirement target approaches – Flexible Target, Annuity Target, and Cash Target – which reflect the mix of retirement income options open to savers in the wake of pension freedoms.

The Flexible Target approach moves assets into a cautious multi-asset mix as investors approach retirement, with approximately 26% equity, 49% fixed interest, and 25% cash*on retirement. This approach offers a suitable risk/return profile for investors who opt for drawdown or change their retirement date. As such, it better serves the needs of a ‘typical’ default investor following pension freedoms.

The Annuity Target strategy is designed for schemes who believe most employees will buy an annuity on retirement. These funds move savers into 75% long gilts and 25% cash on retirement.

Finally, the Cash Target strategy is designed for savers who plan to cash-in their savings on retirement. This is aimed at schemes where most members have very small pots, or are likely to use other sources to create their retirement income (for example those who also have defined benefit pension income).

What’s in the new Workplace Target range?

The new funds broaden choice for employers and scheme members and each fund type offers one or more glidepath option, targeting flexibility, annuity, or cash on retirement.

The new strategies are primarily designed for those workplace investors who do not make an active investment choice or receive advice.

Aegon will continue to offer its existing range of lifestyle funds for workplace investors – all of which target an annuity purchase. This new range offers additional choice to workplace savings schemes.

Nick Dixon, Investment Director at Aegon said:

“Auto-enrolment means that 80%** of workers now view their workplace pension as their main method of saving. As around 72%# stay in their scheme’s default fund, we must offer high-quality investments for those who don’t make active investment decisions.

“Within five years advisers estimate only 25%## of people will look to purchase an annuity at retirement. The dramatic shift in investor behaviour means traditional lifestyle funds which target an annuity by moving into long gilts no longer serve ‘typical’ workplace investors.

“Risk reduction using a diversified investment strategy tends to offer better returns for less risk, especially where investors delay or phase into retirement, and where they choose drawdown.”

|