Inflation falls back to 2% despite Bank of England 4% end of the year prediction

70% of adults are concerned about the impact of high inflation on them personally

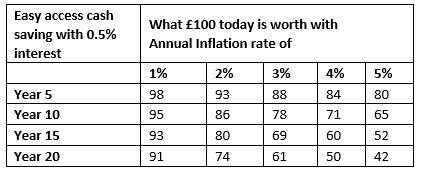

High inflation, even over the medium-term, can have a big impact on people’s purchasing power

Steven Cameron, Pensions Director at Aegon comments: “The inflation figure shows the 12-month CPI rate for July falling back to 2.0%, down from 2.5% the previous month, driven by falls in the prices of clothing and footwear and recreational good and services. After two previous months of rises, this might come as a surprise for those expecting a continued increase towards the Bank of England’s 4% end of the year prediction. The ONS suggest prices usually fall in July during the summer sales season, although incidence of sales were less than previous years and there was upward pressure from transport costs including fuel and second hand cars.

“While this month’s fall may look like a welcome reprieve, it may be a temporary blip ahead of further rises later in the year towards the Bank of England’s 4% prediction. The return of higher and rising inflation is starting to prey on people’s minds, and will be of increasing concern if this is sustained for longer periods. Aegon’s research shows 70% of adults are concerned about the impact of high inflation on them personally. High inflation, even over the medium-term, can have a big impact on people’s purchasing power and with interest rates on cash savings barely scraping above zero, money left in savings accounts is effectively losing value in real terms. Aegon analysis shows that an inflation rate of even 2% will mean £100 today is worth £93 in 5 years’ time while a 4% rate reduces its worth to £84 in a savings account paying 0.5% interest.

“While inflation can’t be completely avoided, developing a financial plan which transfers some savings from cash into investments, for example through a stocks and shares ISA, is more likely to provide real or above inflation growth. We recommend people seek financial advice.”

|