Steven Cameron, Pensions Director at Aegon, comments:

“Today’s figures show the largest annual increase in the number of self-employed since September 2016 with 195,000 more people in self-employment than the previous year taking the total to 4.96 million, meaning it won’t be long till they break the 5 million mark. The self-employed now make up 15.1% of the UK’s labour market and are growing at a faster annual rate than employees. The rise in the self-employed has been a significant feature in the labour market over recent years and follows the emergence of the gig economy and technological advancements that have allowed for more flexible working patterns. However, 3.5 million are full-time self-employed so the numbers are not simply a reflection of individuals taking on part-time self-employment in addition to regular employment**.

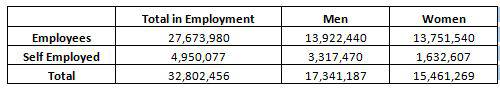

“Despite this major shift to self-employment, women still make up less than third of the total self-employed, or 1.64 million, whereas for people working for an employer this is roughly a 50:50 split.

Table: ONS, Table EMP01

“The growth in the self-employed does not come without significant challenges, particularly when it comes to saving for retirement. There is a clear divide between employees enrolled into a workplace pension and the self-employed who do not benefit from auto-enrolment and the boosts to their retirement savings that come with this such as the employer contribution. Much more is needed to be done to address this inequality and make pension savings the ‘default’ for these workers.”

Reference:

*https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/employmentintheuk/november2019

**https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/articles/labourmarketeconomiccommentary/november2019

|