Kate Smith, head of pensions at Aegon comments: “Workplace pensions are the basis of many people’s retirement income and have been a successful catalyst for employees to begin saving and employers across the spectrum to contribute to auto enrolment schemes. Auto enrolment can now be considered the ‘social norm’ across all eligible groups and occupations.

“In particular it has been a massive step in the right direction to kick start pension saving for young workers and lower paid workers.

“For young workers the contributions at the start of their career can make the biggest difference as they have the longest time to benefit from investment growth, so it is pleasing that participation rates have increased substantially for those aged between 22-29, more than doubling to 85% over the eight years since the introduction of auto enrolment. Those earning between £10,000 and £20,000 have also benefitted with 81% participating, an increase of 47% since 2012.

“As expected those that earn higher salaries, between £50-£60k, have the highest participation rate 93%, presumably because they can most afford to save for their retirement. Gender wise, slightly more women are saving than men, 88% compared to 86%.

“Despite the good news it’s important that we’re not lulled into a false sense of security. Helping people achieve the lifestyle they want in retirement means including more groups that are still currently excluded, particularly low earning women and the self-employed. It also means most will need to pay in more. For an employee in their mid-20s, on average earnings an increase of just 1% on top of the current minimum contribution rate, matched by their employer, could boost their pension pot by around £43,900 at state pension age*.”

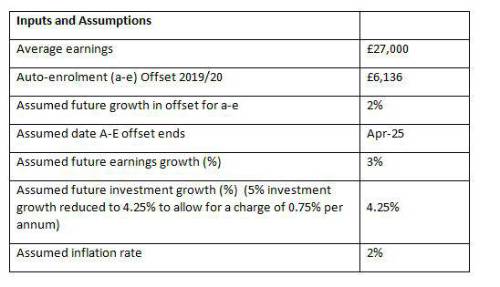

*Fund values are based on the state pension age of 68 for a 25 year old saving for 43 years. The figures assume investments grow at 4.25% after charges and earnings grow at 3% per year. Future calculations assume contributions remain at current auto-enrolment (A-E) minimum rates, 2% higher and 4% higher (for comparison) and a growth in A-E salary offset of 2%, but then being removed in 2025 in line with Government thinking. Fund values are rounded down to the next £100.

DWP workplace pensions figures

|