|

|

Aegon chief executive predicts advice windfall from pension perfect storm |

On business performance Adrian Grace, Chief Executive said: “Earnings proved consistent in the second half of the year and this is the second consecutive quarter in which we’ve delivered earnings of £19m. The strong performance has been achieved through higher earnings from pensions and as a result of lower costs combined with increasing customer numbers. These improvements more than offset lower earnings from life which resulted from our conscious decision to de-risk our investment portfolio under Solvency II.

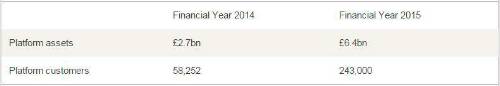

“Our strategic goal is to continue to build the platform and we made good progress in Q4 adding £0.9bn of assets and additional 44,000 customers, with total numbers now over 240,000. The platform business is benefiting from the new pension freedoms with assets in advised drawdown up 88% year-on-year, as customers and their advisers took advantage of the reforms.

“2015 proved to be a successful year in which we’ve delivered total earnings of £91m and added almost £4bn in assets to the platform.

On the pension advice windfall Adrian Grace continues: “Advisers are set to benefit from an advice windfall as market conditions build to deliver a pension perfect storm. The pension freedoms have provided a huge advice boost around income options, investment decisions and passing on wealth through the generations. Next month’s Budget could see significant changes to pensions tax relief, adding further demand for advice, particularly from higher rate tax payers looking to optimise their savings. Combined with one of the most volatile starts to the year in recent stock market history, the value of advice to balance security with flexibility has never been greater.” |

|

|

|

| Deputy Head of Capital | ||

| London - £140,000 Per Annum | ||

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.