• Those within 10 years of retirement with a pension fund over £650,000 need to take care

• Those with defined benefit pensions approaching £50,000 could break the Lifetime Allowance if they transfer to access pension freedoms

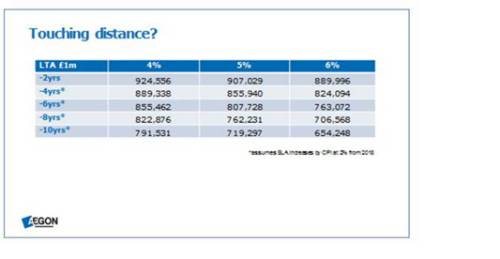

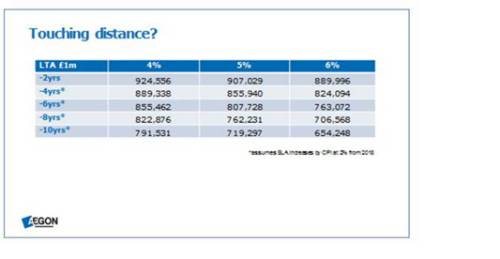

Figures from Aegon look at what fund today would reach the lifetime allowance, even if no further contributions are paid.

The figures allow for the planned increase in the Lifetime Allowance in line with inflation from 2018 /19.

Commenting on the risks, Steven Cameron Regulatory Strategy Director at Aegon said:“It’s not just those who’ve already got a pension fund of over £1m that need to think about the new lower Lifetime Allowance. There’s a much bigger group who need to think ahead to check if ongoing contributions plus future investment growth could push them into a position where they’ll suffer a tax penalty.

“However, for most people, exceeding the Lifetime Allowance is probably a ‘nice problem to have’ and we wouldn’t want individuals to stop contributing unnecessarily or worse still turn down a valuable employer contribution.”

Aegon has also identified a new risk for those in Defined Benefit schemes who might be planning to access the new pension freedoms.

“In a defined benefit scheme, you can have up to £50,000 a year’s pension without breaking the Lifetime limit and incurring a tax charge. That’s a lot more than what £1m would buy you as a regular income from a defined contribution scheme, so good news for those taking their pension from their DB scheme.

“However, Defined Benefit schemes don’t offer the new freedoms to take a variable income amount or even to take the whole lot as a lump sum from age 55. Individuals particularly keen to access these freedoms would need to transfer across to a defined contribution scheme – and there’s a regulatory requirement to first seek professional advice. If you have a defined benefit pension of just under £50k and you’re close to your retirement age, the transfer value you may be offered could be above £1m. That’s good news, but what’s not so good is anything above £1m would be subject to a tax penalty when you start taking our money.

“This shows just how complicated the implications of the Lifetime Allowance are and how important it is to seek professional advice. We would urge the Chancellor to reconsider if these complications can be swept aside to coincide with a move to a new system of tax relief, expected to be announced in the Budget.”