-

3% escalation on a £10,000 pension is worth £85,000 and 5% is worth £170,000

-

Protect your purchasing power by inflation-proofing your pension

However, the pre Referendum warning that the Government might not be able to afford the triple lock on state pensions, and suggestions that some defined benefit schemes might be allowed to scale back on pension increases makes it important that people do understand the value of such increases and what they may lose.

Today, it would cost a 65 year old £190,000 to buy an annuity of £10,000 per annum with no increases. To buy one that increases at 3% each year would cost £275,000 and at 5%, the cost rises further to £360,000. This brings the value of pension increases from state and workplace pensions into sharp perspective.

Kate Smith, head of pensions at Aegon “Pension increases have hit the headlines recently with the triple lock becoming caught up in Brexit discussions with affordability concerns and potential cost-cutting moves to reduce pension increases for Tata Pension Scheme members. The triple lock means state pensions increase at the highest of inflation (CPI), average earnings or 2.5% a year. It has been one of the government’s most popular pension policies which has made a real difference to UK pensioners’ incomes, clearly demonstrating the power of inflation proofing. But few individuals will realise just how valuable it is in money terms – it has cost the Government £6bn a year.

“Equally, those lucky enough to have a defined benefit pension scheme with guaranteed pension increases may not appreciate just how valuable that is.

“The increasing number of people with a defined contribution pension need to make a choice on whether to opt for a higher initial income that doesn’t increase, or a lower initial income with yearly increases. This can either be through taking income through drawdown or by buying an annuity with built in pension increases.

“

People may feel that in a low inflationary environment this isn’t important, but increasingly people are living 20 or more years in retirement and even low-level inflation can erode the value of retirement income over time. And people need to be mindful that we’re experiencing an unusually long period of low inflation and that longer term it might not stay this way.

“You would need a pension pot of around £190,000 to buy a level annuity of £10,000 a year at age 65. If you want to secure 3% yearly increases, the cost increases to £275,000 and 5% increases raise the cost to £360,000. Putting this another way, the value of receiving 3% increases on a workplace pension is £85,000 and 5% increases are valued at an extra £170,000 over a level pension.

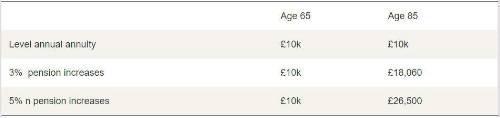

The following table shows the actual annual amount after various rates of pension increase over 20 years.

Kate Smith continues: “If you take a level income of £10k, then if inflation runs at 3% a year, your purchasing power in 20 years’ time would be £7,440 a year in today’s money terms.”

|