-

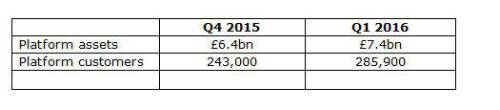

Assets on platform grow to £7.4 billion

-

Aegon’s platform focus becomes clearer with the sale of annuity book and acquisition of BlackRock DC platform and administration business

-

Protection sales grow by 18%

-

LISA an opportunity but also a risk if poorly positioned as a competitor to workplace pensions

Commenting on the outlook for the market and the forthcoming LISA, Grace continues: “Historically insurers have had similar business models but after a period of seismic changes in technology, regulation and consumer attitudes, provider strategies and their diversity are becoming apparent. There’s a clear distinction emerging between those pursuing growth based on modern platform propositions with adviser support versus those opting to maintain legacy books.

“In recent years insurers have channelled their efforts into adapting to regulatory change in the form of auto-enrolment, the charge cap and pension freedoms. While these Government initiatives have increased savings and customer engagement, they’ve come at the expense of industry and customer driven innovation. I see 2016 as the year this will change with providers beginning to show their strategic hand as technology increasingly redefines business models in every sector. For pensions and savings, a clear digital strategy is essential to enable advisers and employers to offer simple, straightforward and holistic services.

“Government initiatives will continue, with its latest, the Lifetime ISA, likely to prove popular in some segments of the savings market. But it also presents risks if poorly positioned as a competitor to workplace pensions, encouraging individuals to opt out and lose valuable employer contributions. Muddying the waters between retirement and other forms of savings could reverse achievements in recent years, so we need to be able to explain the merits of each and distinctions between the two, with platforms ideally positioned to facilitate a cross-savings view. Pensions with the addition of employer contributions and tax relief will come out on top if individuals are looking towards retirement saving.”

|