Andy Bell CEO of Investment platform AJ Bell says,

“Pension savers are punch drunk with acronyms but at least most of them relate to terms which the customer understands. This tongue twister of an acronym is reflective of the rush in which this legislation has been introduced.”

“I am not convinced the demand really exists for HufflePuffles in the retail market in which flexi-access drawdown can achieve the same and more. However we are still faced with the challenge of explaining this option to pension savers as they are trying to make sense of the myriad of various options open to them. For retail pension savers full withdrawal under flexi-access drawdown (FAD) can achieve the same result. We plan to satisfy the needs of customers by going down this route of full withdrawal FAD.”

“Let’s not forget the FCA’s recent Dear CEO letter which places a second line of defence responsibility on pension providers, this to help protect pension savers from making poor benefit choices. Simplification can only help us all meet our responsibilities in this area.”

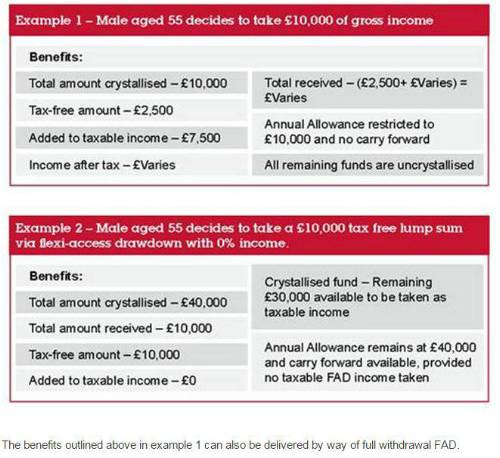

“UFPLS was introduced for pension schemes, such as occupational, that couldn’t offer flexi-access drawdown. In the retail market, I sense that most customers and their advisers will still opt to take a maximum lump sum with no income under FAD as their preferred option (see example 2). This has always been by far the most popular choice of customers entering drawdown.

For those wanting payments involving a mix of taxable and non-taxable income this can be achieved by using full withdrawal FAD. With this in mind there is a clear case for simplification and a question mark over whether UFPLS has a place in the retail drawdown market.”

“We will be offering Full Withdrawal FAD for payments from 6 April 2015. Let’s hope we know what the FCA’s full requirements will be by then!”

What is a HufflePuffle? Certain conditions must be met:-

-

The pension saver must be over age 55 (or eligible for early retirement due to ill-health)

-

The individual must have available Lifetime Allowance (LTA):

-

It is only available from uncrystallised funds (i.e. not drawdown)

-

It is not available with primary or enhanced protection where PCLS entitlement is greater than 25%.

A HufflePuffle is not a tax free lump sum (AKA a pension commencement lump sum) - it is a combination of a tax free lump sum and a one off taxable income payment.

The main difference is that you do not create a drawdown fund in the pension. This means the option can be offered by pension schemes which cannot offer a flexi-access drawdown option but it also has consequences for taxation.

25% of the value of the crystallised amount is paid tax free and the remaining 75% will be treated as part of the pension saver’s taxable income and taxed accordingly.

Taking this route will also trigger the Money Purchase Annual Allowance (MPAA) of £10,000 (reduced from £40,000) and there will be no option to carry forward any unused annual allowance.

|