Analysis of the Financial Conduct Authority’s (FCA) Financial Lives Survey data reveals that 6.9 million UK adults hold Private Medical Insurance (PMI) – a number predicted to rise sharply as businesses look to support the health of their employees.

The analysis of the data by Broadstone, a leading independent consultancy, uncovers that 13% of UK adults have PMI. This equates to around 6.9 million people, a number that has risen by 1 million in the five years since the FCA first started its research.

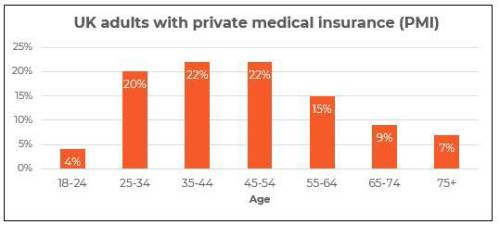

Three-quarters (76%) of those with PMI said that they hold it as part of an employee benefits package with around a fifth (19%) of workers self-funding. The age groups with the highest level of coverage were those aged between 35-44 and 45-54 years old, with 22% of each group holding PMI.

The number of people – especially workers – is expected to continue to accelerate because of the surge in economic inactivity due to chronic illness amid the struggles in the NHS which means many people are struggling to readily access healthcare.

The latest update from the Private Health Information Network (PHIN) showed that private health admissions surged in 2022 and recorded the largest ever quarterly total of admissions in Q1 2023 (227,000), largely driven by increases in insured treatments.

Brett Hill, Head of Health & Protection at leading independent consultancy Broadstone, commented: “The FCA’s research paints a helpful portrait of the PMI sector and shows its importance as an employee benefit with coverage concentrated among working adults.

“Given the crisis in the NHS and the surging levels of economic inactivity due to chronic illness, we expect growth in coverage of PMI to continue, and most likely accelerate, in its current upwards trajectory.

“The conversations we are having on a daily basis with clients demonstrate how healthcare is now a board-level discussion, with CEOs recognising how crucial it is that they act to keep their staff healthy if the public health service can no longer guarantee to do so.”

|