Almost half (46%) didn’t report these suspicious communications, even though they suspected it was a financial scam. The most common (41%) reason given was because they didn't know who to report the communication to.

Peter Hazlewood, Group Financial Crime Risk Director at Aviva, said: “While the types of financial scams are generally the same as those before the pandemic, fraudsters are exploiting the pandemic to take advantage of people when they are at their most vulnerable. They are using coronavirus as a pretext to lure potential victims. The scams range from attempts to sell people unsuitable insurance to, at worst, stealing their entire retirement savings. The impact on victims is not just financial either, it has a detrimental effect on people’s mental wellbeing too.”

The research found that 1 in 12 (8%) of those surveyed have been the victim of a financial scam which related to coronavirus. Of those, 41% said being the victim of a scam negatively affected their mental health. In June this year, Action Fraud reported £5million having been lost to fraud since February. However, if only half of people report suspicious communications this could be the tip of the iceberg.

Peter Hazlewood commented: “The tactics deployed by fraudsters constantly evolve. As lockdown measures are eased, it’s inevitable the fraudsters’ tactics will again develop beyond coronavirus. It’s more important than ever that people remain vigilant - particularly with respect to protecting their personal data - reporting any suspicious communication to Action Fraud, their financial services provider or the Police. The best chance we have of catching these criminals is through better information sharing. The industry needs to work together with the authorities to support each other in protecting the public and our customers.”

Aviva launched its online fraud information and reporting service on its website at the height of the pandemic to help protect the public and its customers from scams.

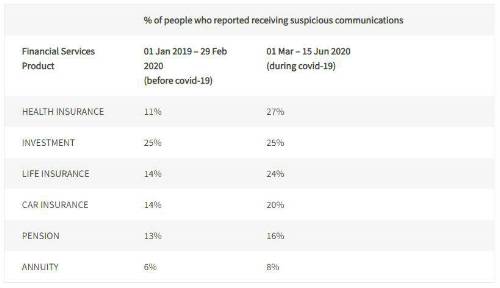

Increase in suspicious email, text and phone calls since covid-19 pandemic

If further evidence were needed to expose the unscrupulous nature of these fraudsters and how they prey on people’s fears, the research shows that suspicious communications, such as emails, texts and phone calls etc. which relate to health insurance increased by 15 percentage points since the pandemic. There were also increases in suspicious communications linked to life insurance (10%) car insurance (7%), pensions (3%) and annuities (2%).

Table 1: Suspicious email, text or phone calls by financial services product – before and after the pandemic:

Most common scams

The Policy Review: A typical Health and Life insurance scam involves a cold call telling consumers “It’s time to review your policy”. The fraudsters will claim they’re from a reputable insurance company or that they’ve been asked to do this by the regulators – all in a bid to gain trust. They may offer lower premiums but what they don’t mention is that the lower premium also means reduced cover – often leaving the consumer with a worthless policy.

Ghost-broking: Known as ghost policies, these make-believe car insurance policies are set up by fraudsters to entice consumers into buying them at an ‘ultra-low price’. In 2019, we found over 4,000 instances of policy fraud that were linked to ghost policies. Criminals can make these bogus products look like the real thing, even providing seemingly genuine policy documents – but they’re far from it. They don’t cover the customer or a third party.

Pensions, Investment & Savings: As stock markets have fallen in value and the Bank of England interest rate is at 0.1%, people with investments are much more vulnerable to falling victim to scammers offering unrealistically high rates of return. People are usually offered a ‘unique’ investment opportunity or the chance to unlock cash in a pension.

Hazlewood continued: “It’s clear from our research that fraudsters will use whatever tactics necessary to get hold of people’s hard-earned money. If you're interested in getting a lower premium or taking out a new insurance policy, do a bit of research yourself – and don’t be forced into anything by unexpected phone calls from strangers. If you’re not sure whether a financial services company or a communication is legitimate, report it – to us, Action Fraud or the Police. And, while this may feel like an unsettling time for many, the advice we’d give to people is not to panic. When it comes to investments, decisions made in haste and under stress are rarely good ones.”

Top 5 professions most likely to have fallen victim to a scam during coronavirus pandemic:

1. Accountant (22%)

2. IT (17%)

3. Customer service (11%)

4. Administration (8%)

5. Teacher (5%)

Commenting, Peter Hazlewood said: “You might think people who have a professional qualification, like accountants, and those working within IT would be more resilient to scams. However, becoming a victim of fraud can happen to anyone. People often feel embarrassed to admit they have fallen for a scam but there is no shame in it - these fraudsters are surprisingly professional and convincing.”

Aviva’s online fraud information and reporting service

Aviva’s online fraud reporting service launched in May 2020, at the height of the pandemic. It allows people to report any suspicious contact which appears to be from Aviva, whether it be in person, or by post, email, call or text - particularly those which relate to insurance, savings and retirement products. Aviva’s Financial Crime Intelligence Unit investigate every incident which is reported, respond and give guidance to individuals about what action to take. The scam reporting service can be accessed via Aviva’s new Fraud Hub on its website. The new Fraud Hub is also home to a wealth of practical tips and information about how people can best protect themselves and their money against fraud. Aviva’s Fraud Hub

Aviva Fraud Report July 2020

|