By Mark Futcher, Partner at Barnett Waddingham By Mark Futcher, Partner at Barnett Waddingham

The Pensions Act 2008 places a duty on employers to auto enrol eligible employees into a “Qualifying Workplace Pension Scheme” (QWPS). This requirement will begin to apply from October 2012, and will be staged over a five year period, starting with the largest employers. An employer may however apply to have its staging date brought forward to another specified staging date that is more convenient to the business.

Eligible employees will be those aged between 22 and State Pension Age who have earnings in excess of the income tax threshold which the Government has confirmed is £7,475 for 2011/2012 (the earnings trigger).

Employees who learn less than the income tax threshold and/or fall outside of the age range will be able to opt in to a QWPS if they wish. If they do so their employer will have to make payments on the same basis as if they were earning above the income tax threshold, however contributions will only be based on earnings above the threshold of £5,715 in 2011/2012 terms. Qualifying Earnings will be total earnings (i.e. not restricted to base salary), which fall within a band of earnings, currently from £5,715 to £38,185 per year in 2011/2012 terms. The upper and lower levels of the band are expected to increase annually and will be decided by the Secretary of State.

Employees who earn less than this threshold can also pay contributions voluntarily, but their employer will not be expected to make payments.

Employers will be able to use a QWPS to meet these new Auto Enrolment duties which could be either a current employer sponsored pension arrangement that fulfils the minimum requirements or NEST (the name of the new state backed national workplace pension scheme)

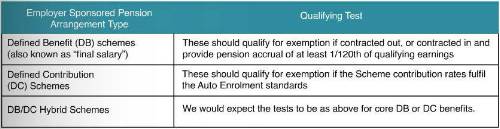

The proposed qualifying tests for employer sponsored pension arrangements to gain exemption from having to use NEST are detailed in the table below.

Employers must automatically enrol employees in line with their relevant staging date, in the first month of employment or when an existing employee first becomes eligible. Employees will be able to opt out, but employers may face financial penalties if they include this. Employees are unable to opt out until they have been auto enrolled into a QWPS. Employees who do opt out will have to be automatically re-enrolled every 3 years, unless they choose to opt out again.

The employer can fix the re-enrolment date to their original staging date rather than the employee’s joining date so that they will only need to go through the re-enrolment process once a year. The re-enrolment date can be fixed to fall within three months either side of the anniversary of the staging date.

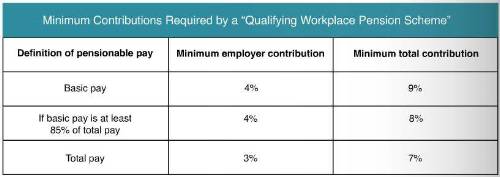

Originally, the minimum contribution required under a QWPS was 8% of an employee’s Qualifying Earnings, made up of a member contribution of 4%, an employer’s contribution of 3% and 1% from the Government in the form of tax relief. Some easement has been given to the definition of pensionable pay and the level of contributions required following a Department for Work and Pensions report issued on 27th October 2012. Companies will now have the option to satisfy one of the following three tests:

These minimum contribution rates will be phased in over a 5 year period. If the minimum total contribution as outlined above is 8%, the phasing dates will be as set out in the table below.

The Pensions Regulator will have a new role in ensuring compliance with the Automatic Enrolment regime. Employers will need to register all QWPSs that are used to comply aith Auto Enrolment with Pensions

Regulator, although currently, the exact nature of how this will be enforced is yet to be determined. We believe it likely, however, that a combination of written reminders/ formal notifications and ultimately, financial penalties will be utilised.

What needs to be done?

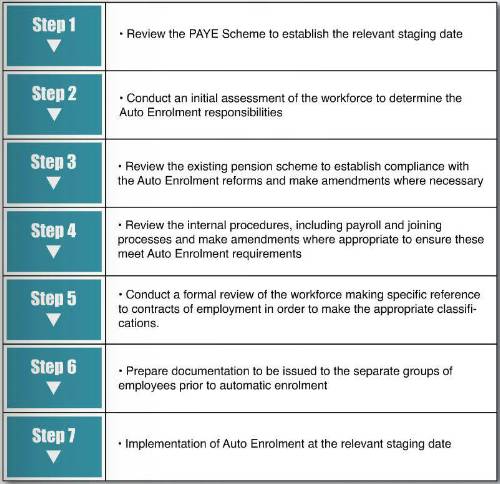

There is a lot for an employer to consider leading up to Auto Enrolment. The diagram below sets out what we believe are the main steps to ensuring compliance with the new legislation:

|

By Mark Futcher, Partner at Barnett Waddingham

By Mark Futcher, Partner at Barnett Waddingham