By Fred Vosvenieks, Consulting Actuary, Milliman & Russell Ward, Consulting Actuary, Milliman

There is growing interest in risk factor based investment portfolios as an alternative to traditional asset allocation methods. In this article, we look at how risk factors directly address some of the main weaknesses of traditional methods and review the practical challenges that will need to be tackled ahead of more widespread adoption.

Traditional Thinking

Investment portfolio construction has traditionally centred on the idea that a superior outcome in terms of risk versus return can be achievedby investing across uncorrelated assets. However, all too often, the concept of risk has been equated somewhat myopically with a single measure, volatility, which is at best a proxy for the uncertainty associated with future asset returns. Alongside the simplifyingassumption of fixed correlations between asset classes,this has led to investment strategies that combined ‘growth’ assets with ‘defensive’ assets but whichultimately provided neither to the end investor.

We can observe that the historical weaknesses in constructing resilient portfolios have been driven by a fundamental misunderstanding of the dynamics of risk and the sources of uncertainty. A focus on the allocation of capital rather than risk means that traditional approaches fail to capture the common causal drivers that exist across issuers, geographical locations, and asset classes.

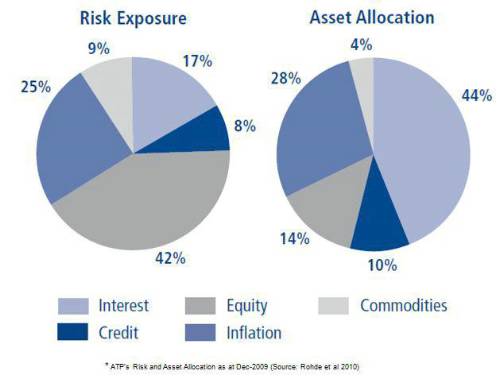

Even with increased investment in a wider range of assets, diversification is no guarantee of increased risk protection, particularly during times of stress when it is needed most. A good example of the significant difference between capital and risk allocation is provided by the Danish Pension Fund ATP, as shown in the figure below.

The prevalence of simple measures of performance, such as fund benchmarking, as tools used by both asset managers and advisors to address their client’s needs speaks all too clearly to the need for a new framework that better addresses an investor’s specific objectives and risk appetite.

An alternative form of portfolio construction is now emerging which focuses directly on the core drivers of return within each asset class – the so-called ‘risk factors’. By identifying the risk factors common to multiple asset classes, we can develop a much deeper understanding of how the behaviour of asset returns are linked (i.e. correlated) and therefore begin to build more robust, resilient portfolios.

Over recent years, risk factor investment frameworks have started to reach into the mainstream academic and practitioner literature. Not surprisingly, this has been accompanied by an increasing trend towards riskfactor investing amongst professional asset management firms. We believe there is now growing consensus that many asset classes often end up being driven by the same risk factor –this undermines traditional thinking that asset classes are relatively heterogeneous security classification structures.

From Asset Allocation to Risk Allocation

Decomposing an asset return into the different risk factor building blocks reveals the component drivers that actually explain the source of that return. So, we define a risk factor as a causal driver of asset returns that has risk, return, and relationship characteristics with other risk factors. All risk factors have a degree of uncertainty or risk associated with them, and a corresponding risk premium which may be positive or negative.

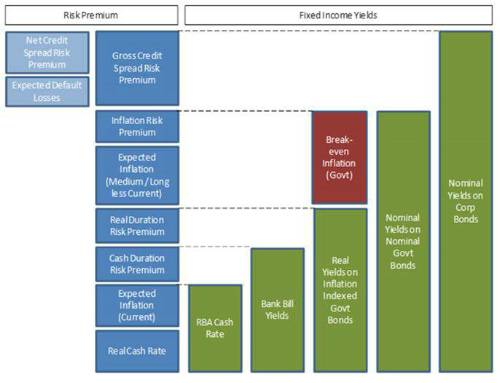

The following diagram illustrates how the yields on various fixed income assets can be broken down into their component risk factors.

As well as those shown above, commonly observed risk factors extend to include those related to political risk, economic growth, demographic shifts, manager skill, optionality and liquidity. That is by no means an exhaustive list, but helps to illustrate the open mindset which should be adopted when reviewing asset classes and their risk factor exposures. It is also important to acknowledge that the extent to which risk factors influence different asset classes will vary over time – in this way we avoid a similar trap to the assumption of static correlations.

By identifying the risk factors associated with each main asset class, it becomes clear that “uncorrelated” assets are, in fact, exposed to the same drivers of return,so allocating capital across asset classes will only ever provide superficial diversification. But if we can invest such that our portfolio diversifies across risk factors, then we should obtain far greater protection against regime shifts, black swan events and other sources of market turbulence.

In summary, the benefits of a risk factor based investment framework should be:

• a greater focus of the investment process on the fundamental causal drivers and sources of return;

• a much greater understanding of the risk exposures an investor can gain exposure to, replacing the flawed reliance on volatility as a measure of risk;

• greater insight into the inter-relationships between assets provided by an awareness of the dynamics of and between risk factors; and

• a common framework and language for understanding and managing both sides of the balance sheet, since risk factors also drive liabilities and the associated cash flows.

Returning to the advice process, it is now increasingly important that an understanding of an investor’s current and on-going tolerance to risk is obtained alongside a consideration of their investment objectives. At its heart, portfolio construction should always be about identifying the available investment options that provide the future payoff profiles to mitigate the investor’s risk exposures.

It is here that traditional approaches fall short, with minimal attention paid to the risks an investor is actually exposed to or how best to apply their capital to mitigate them. Jumping straight to the asset allocation decision isn’t the answer – weneed to review potential risks and payoffs, and accept that some trade-offs will be required.

Paired with enhancements to risk profiling at the advice stage, to obtain more granular information pertaining to an investor’s appetite and capacity for risk, the technical benefits associated with risk factors should bringcloser alignment to the investor’s investment objectives and liability profile. Risk factor based investment should also provide a far more transparent basis for articulating how the performance of a chosen strategy compares with those objectives.

So if the benefits are clear, why aren’t more asset managers, banks, and insurers actively using the approach? Firstly there are the practical challenges associated with investing in risk factors. Since direct investment is not always available, extreme offsetting positions or derivatives may be required to gain exposure to risk factors. Such strategies may fall foul of existinginvestment rules and limits. Even in the absence of such constraints, we may only be able to approximately replicate certain risk factors, while for others there may be no current mechanism to access them at all. Many of these challenges will no doubt be addressed as risk factor based investment frameworks gain traction and see wider market adoption, either through bespoke solutions or potentially the introduction of new risk (rather than asset) based instruments.

Modelling risk factors to provide forward looking estimates of portfolio returns is a further challenge but a critical first step.We recommend a move away from traditional statistical methods in favour of causal models, such as Bayesian Networks, which not only provide a forecast of future returns but a transparent explanation behind that forecast. Causal models provide a framework for explicitly capturing the non-linear system of relationships driving return, permit the transparent combination of historic data with expert judgement, and facilitate a wide range of stress and scenario testing and reverse stress-testing. The resulting return estimates, rather than being fitted to historical data using standard statistical distributions, reflect the non-linear dynamics of how performance can change according to the underlying economic and business drivers.

Risk factor based frameworks show enormous potentialfor making investment risk more transparent and, over time, this should dramatically improve our ability to directly address an investor’s ongoing appetite and capacity for risk.

|