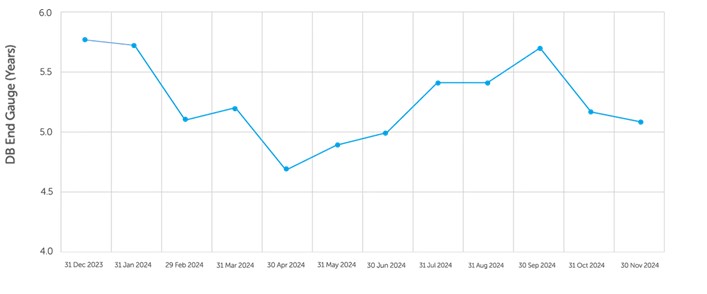

As of 30 November 2024, Barnett Waddingham’s DB End Gauge index was 5.1 years to buyout.

The estimated aggregate surplus on a low dependency basis is £60bn. If refunded in full, this would result in around £45bn being paid to the FTSE350 companies and £15bn being paid to HMRC in tax.

As of 30 November 2024, the estimated low dependency surplus in the FTSE350 schemes was £60bn. The aggregate surplus is estimated to have increased over the last six months, from £45bn at 31 May 2024 to £60bn at the 30 November 2024, primarily due to strong asset returns and lower expectations for future inflation over the period.

Lewys Curteis, Principal at Barnett Waddingham says: “As we approach the end of the calendar year, the UK’s DB pension schemes remain in a robust financial position. Disappointingly, the much-anticipated response to the “Options for Defined Benefit schemes” consultation has not yet emerged, and private sector DB pension reforms were omitted entirely from the recent Mansion House speech. Our analysis illustrates the significant opportunity that currently presides in the UK DB pensions market – unlocking the value in these schemes would provide a welcome boost for companies, Government and the wider economy.”

You can follow the index here.

Methodology

DB End Gauge is calculated using publicly available data collected from the annual accounts of the FTSE 350 companies. As such, it covers around 150 companies with DB pension arrangements and is calculated as the average of the estimated time to reach buyout funding for each scheme.

|