Analysis shows who would benefit most from investing in a Lifetime ISA

Key points:

-

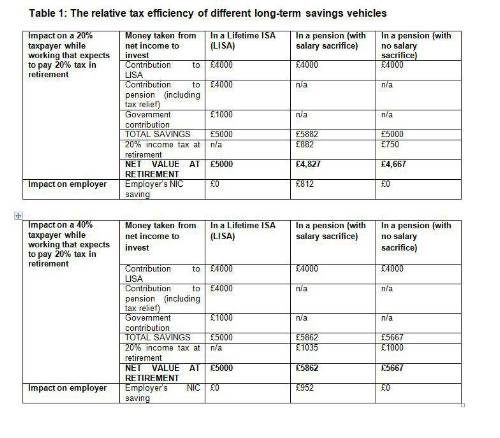

LISA is attractive for most 20% taxpayers

-

Pension saving is still the best long-term savings option for 40% taxpayers

-

Pension saving that attracts an employer matching contribution remain the best option for all. This includes auto-enrolment schemes

-

Everyone under 40 should open a LISA to provide increased savings flexibility through to age 50

Commenting, Chris Noon, Partner at Hymans Robertson, said: “When you first look at it, a LISA looks like an attractive option and it will be a good savings solution for some. It gives everyone under 40 more choice around how to save. It’s essentially an extension of the freedom and choice agenda.

“While LISAs come with an incentive – in the form of a Government top up, they also come with penalties for early access. Pensions also come with strong incentives to save, in the form of tax relief and employer matching contributions.

“The best option for an individual will depend on whether they need flexibility, the incentives available to them and the level of income tax they pay. As ever, with choice comes complexity. People will need guidance to make the right decisions for them.

“Generally for basic rate taxpayers, investing in a pension with matched employer contributions represents the best option. A LISA is then the next best vehicle, followed by a pension - if you stay within lifetime and annual allowance limits, then an ISA.

“For higher rate tax payers, a pension with matched employer contributions is generally the best option for long-term savings. But for higher earners investing in a pension up to annual and lifetime allowance limits is a better option than a LISA, which in turn is a more efficient option than standard ISA.

Discussing issues to be aware of when investing in a LISA, he added: “People will be hugely attracted by the flexibility that comes with LISAs and the prospect of Government top ups. However, there are a couple of health warnings. First, if your employer matches your contributions into a workplace pension, be aware that saving into a LISA instead means employees could lose this match. Saving into a pension with an employer contribution generally remains the best route for most.

“Second, many individuals invest in cash ISAs. If the ISA is kept for the long-term this investment strategy is likely to result in significant lower savings outcomes for individuals.

“Faced with these issues it’s vital that individuals get much needed support and guidance to avoid making the wrong choices. Employers have a role to play here. We expect many employers to provide LISAs in the workplace to run alongside pension plans. This would allow employers to guide and inform their staff’s decision making. They can also secure better rates from providers.”

Discussing why everyone should open a LISA, he added: “Everyone under 40, particularly high earners and ‘high flyers’, should open a LISA even if they don’t invest in it straight away. From April a horrendously complex system of annual and lifetime allowances for pension savings come into force. These can affect those earning £90k p.a., and sometimes less, due to the way income is assessed by the Government. It makes sense for everyone, even if they’re not currently a ‘high earner’, to have this fall back to guarantee having an alternative tax efficient route to save towards retirement in the future.”

|