This is the first annual rise in car insurance premiums since the autumn of 2020, following a second consecutive quarter of price rises and implementation of the new FCA pricing rules on 1 January 2022, as car insurance premiums increase by 4% (£21) in the first three months of this year, according to the longest established and most comprehensive car insurance price index in the UK. The index is based on price data compiled from over six million customer quotes per quarter.

Source: WTW / Confused.com Car Insurance Price Index. *Values rounded to nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “Throughout the peak of the pandemic we saw motor insurance premiums consistently fall. But as people return to more normal patterns of work and life, we are seeing those reductions in premiums gradually unwind. This has been caused by a rise in claims, due to an increase in the number of journeys being taken, coupled with increasing inflationary pressures across the whole economy.”

The cost of comprehensive car insurance over the last three months increased across all regions in the UK, with drivers in the East and North East of Scotland experiencing the sharpest quarterly rise at 7% (£25), with average premiums now costing £401, followed by the Scottish Borders (£22), Scottish Highlands and Islands (£24) and the South West of England (£23), which all saw a 7% rise.

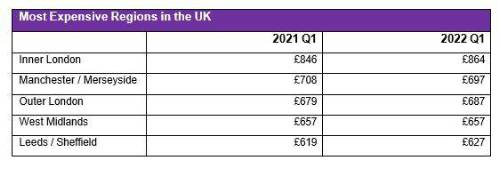

Despite the high quarterly increase, the Scottish Borders continues to be the cheapest region for car insurance, where prices average £370, followed by the South West of England (£376). The smallest quarterly increases of 2% were seen in Manchester/Merseyside (£15), where average premiums are now £697, and the West Midlands (£14) nudging average annual premiums up to £657.

More locally focused data shows motorists in Dorchester (10%) experienced the greatest quarterly increase in premiums to £371, with West Central London (£1053) and East London (£988) continuing to be the most expensive postcodes in the country. Even with the 7% quarterly rise in prices, Llandrindod Wells in Wales remains the cheapest town in the UK, with drivers paying an average bill of £338 in the first quarter of 2022 for comprehensive car insurance.

The demographic that saw the greatest quarterly increase was people aged over 70 who saw their car insurance rise by 7% on average, taking premiums to £376. Eighteen-year-old drivers are still paying the most of any demographic – despite premiums increasing only 0.4% this quarter – taking average premiums to £1419.

Tim Rourke said: “The rest of 2022 is likely to be characterised by persistently high inflation and insurers are also adjusting to the new FCA pricing rules while maintaining margins. With that in mind, we expect motor premiums to continue to trend upwards throughout the rest of this year as prices return towards their pre-pandemic peak.”

Louise O’Shea, CEO at Confused.com comments: “This is the second consecutive quarter where we’ve seen car insurance prices increase, which suggests that unfortunately this is something we were going to face regardless of the FCA pricing changes. But now we’re also seeing an arguably very competitive market.

“With prices increasing across the board, our research1 shows this has been reflected in people’s renewals, with many seeing their renewal price has increased more than the cost of a new policy has increased. And this means insurers are having to adjust their pricing and compete to attract new customers. This is a battle we’re likely to see for some time, which is going to make insights into the pricing trends even more attractive to insurers.

“Prices could continue to increase simply because insurers are likely to be facing more claims than last year, as people start to drive more frequently, and this just means insurers will have to be as competitive as possible. And in turn consumers will need to continue to shop around, as the assumption that renewal prices won’t increase clearly isn’t true.”

|