By Tim Gosden, Head of Strategy for Legal & General’s individual annuity business

As well as the 25% tax free lump sum, consumers can take the rest of their fund as cash but subject to their marginal rate of income tax. This blows away the current system where most consumers have little choice but to buy a lifetime pension annuity. They will have total freedom to do what they want with their pensions savings and to even ‘buy a Lamborghini if they want to’ as the Pension Minister said after the Budget announcement.

So just for reference purposes, in 2013 over 90% of retirement income contracts sold, that's both annuities and income drawdown, were annuities and the annuity market was worth approximately £12 billion. The average DC pot used to buy an annuity was £35,000 and the median pot was around £20,000.

The need for such wholesale reform was based on the findings of the FCA Thematic Review of the annuity market and consistent media coverage calling for change and more flexible retirement options than just annuities. The Treasury view is that given improvements in life expectancy, annuities are no longer the right product for everyone and the market itself is not working in the best interests of all consumers, being neither competitive nor innovative.

Drawing on experience from overseas markets the Treasury cited the pensions systems in Australia and the USA as examples of where consumers have access to their funds and are trusted to manage their own finances in retirement. And while trust and responsibility are consistent themes in the UK reform there is also a caveat that every consumer will get free impartial, face to face guidance to help ensure they are aware of their choices and are able to make informed decisions, that best suit their needs.

Gauging the effect on the annuity market

Looking at the pension systems in the USA and Australia, then traditional lifetime annuities, as we know them, account for a small portion of product sales, less than 5% in both cases. So perhaps based on this experience the initial predictions for the UK annuity market next year are very pessimistic, with forecasts that sales may reduce by as much as 80%. Feedback from the market right now suggests sales are down by as much as 50% as consumers defer their retirement planning until April next year, when they will be able to take advantage of the new rules.

What can we learn from overseas markets?

Overseas models can tell us a great deal but we need to be wary as they are very different markets and there are also cultural differences. Currently in the UK we have a line in the sand between saving in a pension, the accumulation stage and taking money out, the decumulation stage. In order to get money out consumers have to buy a new product like a pension annuity or income drawdown. And because of the one off and irreversible nature of annuity purchase, then shopping around, health disclosure and making the right choices about the shape of the annuity are crucial to ensure the best possible outcome.

In the USA and Australia that boundary is much less defined with many consumers just rolling over into an income and/or withdrawals within their employer’s pension scheme. Subject to certain restrictions in both countries, consumers can draw what they want, when they want and in effect have a retirement bank account with the ability to keep on contributing if they want to. So it is not surprising that the concept of locking money away in a UK style lifetime annuity, without access, is not very appealing to consumers in US and Australian markets. Certainly in Australia, the annuity products offered by Challenger, one of the leading annuity providers in this market, offer consumers access to their funds.

That said, in both countries there is growing concern over longevity issues, particularly in Australia where people can expect to live longer than in the UK. There appears to be a renewed focus on the value of the annuity lifetime income guarantee and in Australia consideration of restrictions on the current freedoms consumers have in terms of accessing their funds. And while lifetime annuity sales are small in Australia (circa $240m in 2013), they are steadily growing with Challenger, the leading provider, reporting record sales both last year and in the first quarter of this year.

How do consumers spend their money overseas?

According to research last year by the Australian Financial Services Council and ING Direct, the average ‘Super’ pension balance is around $112,000 (£62,000) for women and $198,000 (£109,000) for men and almost two thirds of those surveyed said they didn’t believe they would have enough for a comfortable retirement. So perhaps it is not so surprising that there are numerous articles suggesting that most Australians are sensible about how they use their retirement funds. When it comes to decumulation around two thirds of middle ground savers use account based pensions, similar to income drawdown, to provide an income stream but with people still using their pension funds for other means. According to Challenger research (See chart below) 32% used their funds for housing related expenditure, which included paying off the mortgage, home improvements or a new home and only 4% in this survey, purchased an annuity.

Legal & General research carried out in April 2014 revealed that UK consumers are thinking along the same lines. Freed from the necessity of having to buy an annuity, consumers were generally upbeat and optimistic about a future that puts them in control. Moreover, when asked what they will spend their money on, property was a recurrent focal point. To the least affluent that meant paying off their mortgage and for the most affluent extending their existing property portfolio, as well as property extensions/refits.

Australia, use of lump sum (65 and over) Source: Challenger

|

|

Female |

Total |

|

Number of people who received a lump sum |

206.6 |

|

|

All methods of disbursement of lump sum payment from super |

|

|

|

Rolled it over/ invested it in an approved deposit fund/ deferred annuity or other super scheme |

43.9 |

21% |

|

Invested the money elsewhere/ personal savings/ bank |

55.6 |

27% |

|

Purchased an immediate annuity |

7.3 |

4% |

|

Paid off home/paid for home improvements/ bought new home |

66 |

32% |

|

Bought or paid off car/ vehicle |

38.3 |

19% |

|

Cleared other outstanding debts |

24.6 |

12% |

|

Paid for a holiday |

28.8 |

14% |

|

Assisted family members |

9.5 |

5% |

|

Undecided/ Did not know |

7.4 |

4% |

|

Other |

12.6 |

6% |

What might happen over here, next year?

Taking on board the Australian experience, it’s probably safe to assume that most UK consumers will be responsible with their retirement savings. It’s likely that many of those with smaller funds, say less than £30,000, will probably spend their pension fund on short term needs such as paying off debts or their mortgage. Hopefully the guarantee of free impartial guidance will ensure they understand the potential tax implications of doing this and also the amount of state pension they will have to live on in their retirement.

For the middle ground savers with more in the way of DC funds and perhaps a Defined Benefit,(DB) preserved pension, a sensible strategy might be secure a bedrock lifetime income stream comprising a lifetime annuity, DB pension and state pension to cover core living expenses. For those with funds above this level, they will have the freedom to do what they want.

In Australia, Challenger estimates the bed rock income stream to be around $30,000pa (£16,500pa) for an average household. In the UK then according to the ONS, 5th decile earnings for two adults is £27,000pa, so translated into an average retirement income of two thirds, this means an equivalent annual income for a UK household of approximately £18,000pa may be required.

The new freedoms do conjure up some excellent planning opportunities. For example, in past articles I’ve mentioned a U shaped income stream in retirement that reflects consumers spending more in the early years, when they are active, less in the middle period when they become more inactive and then more towards the end of their life, when around one in three may require care funding. For many people that’s a very difficult income model to accommodate with the current system but the new freedoms now make this income flow over time a possibility.

To end on a positive note and contrary to what the Treasury thinks, the UK has the most advanced retirement income market in the world, which is a great foundation on which to introduce these new reforms. Undoubtedly, the guidance guarantee will help ensure that most consumers do make the best choices. With that in mind, I think annuities will still have an important role to play in the UK market and it will be interesting to see how overseas annuity markets develop over the next few years.

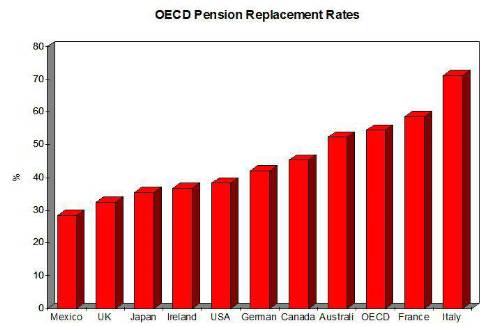

Perhaps the real fly in the ointment is the level of the UK state pension, because the OECD UK pension replacement rate, (see chart below) shows that for full career workers, at just 32.6% the UK state pension is one of the lowest across the OECD counties. Only Mexico has a worse rate. In contrast, Australia has a pension replacement rate of 53.3% and the USA 38.3%.

So while Australians in particular, have a solid income buffer to fall back on should their funds run out, in the UK the consequences could be much worse for some people.

*Based on 2011/12 ONS average gross income for middle fifth of retired households

|