Around a fifth (20%) don’t think annuities offer good value, despite annuity rates being at a near 14-year high, having increased by almost 50% in the past 18 months.

Over two-fifths of the over 50s (44%) regard annuities as inflexible. Annuities can be flexible, with retirement account style annuities having the ability to turn income off and on as the customer needs change.

A similar 45% think annuities are risky because if you die earlier than expected, you lose money due to be paid out to you. Longer guarantees and value protection can be chosen at outset which effectively provides a ‘money back’ guarantee that if the annuitant dies early, the remaining income is paid to the nominated beneficiary.

The research also revealed a real lack of awareness and understanding beyond the misconceptions, with a significant number or people sitting on the fence with the statements being asked, despite saying they were at least familiar with annuities. For example, nearly two-fifths (39%) said they neither agreed nor disagreed that annuities offered good value, and nearly a third (31%) were unsure if annuities offered flexibility.

Nick Flynn, retirement income director at Canada Life explains: “Annuities tend to be sold, rather than bought. This is exacerbated by the misconceptions that have built up around annuities as a product which has been out of fashion. But, they are worth more than a cursory second glance. From significantly improved rates, to longer guaranteed periods which effectively provide a money-back option, to retirement account annuities where your income can be switched on and off, there is so much more to explore with annuities than perhaps is seen at face value.

“Working with advisers, the industry needs to work harder to overcome the hurdles and provide clearer arguments to reconsider annuities. After all, they are the only game in town that can offer 100% peace of mind, that whatever happens, your retirement income will continue to be paid.”

Most 50+ year olds that are at least fairly familiar with annuities agree that they provide a guaranteed income for life (69%), that they come in many different types to fit customer needs (57%) and that they are for the rest of your life (55%).

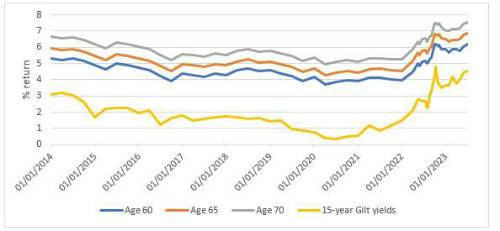

How lifetime annuity rates have changed over time

Source: Canada Life annuity rates over time, as at 01/07/20232

|