The analysis shows that the average annual income from a level without guarantee standard annuity (based on a £10K purchase price) for a 65-year-old has increased by 4.3% since hitting an all-time low in September 2016. This has enabled rates to return to the levels last seen during late July 2016.

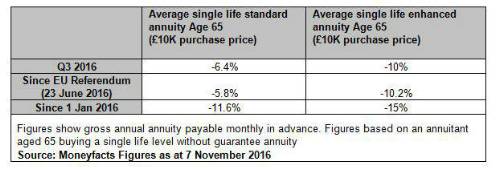

The revival in annuity rates follows a particularly tough Q3 2016, with the latest Moneyfacts Personal Pension and Annuity Trends Treasury Report revealing that average annual standard annuity income fell by 6.4% and average annual enhanced annuity income by 10%. However, despite the recent annuity rate rally, average standard annuity income is still down by 11.6% since the start of the calendar year, and average enhanced annuity income stands 15% lower, making 2016 the worst ever year for annuity rates.

Richard Eagling, Head of Pensions at Moneyfacts, said: “The already testing economic environment for annuity providers deteriorated even further during Q3 2016, as the impact of the EU referendum result and then the Bank of England’s base rate cut and extension of its Quantitative Easing programme triggered large falls in gilt yields. However, gilt yields have since recovered, providing annuity providers with more room to manoeuvre when setting their annuity pricing.

“We had reached a tipping point where annuity rates had fallen to such an extent that many retirees no longer regarded them as value for money, even though they provided the security they desired. Instead, retirees have been delaying annuitising until rates recover, or chasing higher yields through riskier alternatives. It will be interesting to see whether these latest annuity income rises are enough to convince them to return to annuities in order to fix their incomes for life.”

Table 1: % change in average annual annuity income

The Moneyfacts Personal Pension and Annuity Trends Treasury Report, published 25 October, provides a comprehensive review of the UK personal pension and annuity sectors, with detailed analysis of annuity rates, pension fund returns and maturity values

|