As rapid economic development, population growth and urbanisation lead to increased insurance penetration, Asia Pacific represents a key area of growth in the global marketplace. Aon Benfield’s Insurance Risk Study listed five Asian markets in the top 10 of its Country Opportunity Index, which identifies the world’s most promising property and casualty markets. Singapore comes third in the list of 50 countries, immediately followed by Hong Kong, Malaysia and Indonesia.

With an insight into economics fundamentals, rating agency perspectives, political cultures and regulatory environments for local and foreign investors, this guide serves as a snapshot into the 16 countries for global market insurers and reinsurers seeking diversification or Asian firms looking for multi-national expansion.

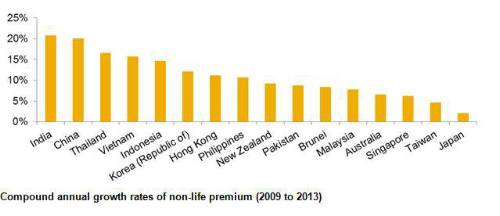

The findings show that India and China – representing the BRIC countries – enjoyed the highest compound annual growth rate (CAGR) of non-life premium at 21% and 20% respectively from 2009 to 2013. Thailand, Vietnam and Indonesia also enjoyed significant growth with CAGR above 15%.

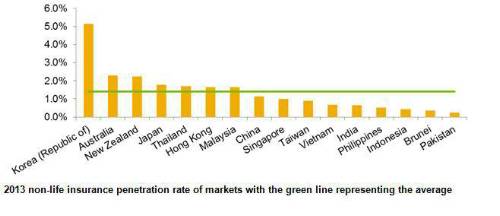

While developing markets in Asia Pacific enjoyed fast growth, the report also reveals that the insurance penetration rates remain low. For the year ended 31 December 2013, non-life penetration rates for India (0.6%), China (1.1%), Vietnam (0.7%) and Indonesia (0.4%) were below the 1.4% Asia Pacific average and well behind developed markets in this region such as Australia, New Zealand and Korea. This highlights the potential of these markets in terms of future opportunities.

2013 non-life insurance penetration rate of markets with the green line representing the average

George Attard, Head of Aon Benfield Analytics for Asia Pacific, commented:

“The Asia Pacific region is home to more than half the world’s population, with diverse societies, cultures, economies and regulatory regimes. Rapid economic development, population growth and urbanisation – combined with rapidly evolving insurance regulation – will lead to increasing insurance penetration. While this will create the potential for significant organic growth, there is also a notable opportunity for growth in specialty lines and product innovation. With many insurance and reinsurance companies already investing in this region and seeking to take advantage of the growth opportunities, an expert insight into these markets is crucial. Aon Benfield’s local teams have produced this guide as both an introduction to and exploration of sixteen key markets in Asia Pacific.”

Malcolm Steingold, CEO of Aon Benfield for Asia Pacific, added:

“The greatest opportunity not only for 2015 but for the immediate future is the development of new products to cater for the expanding universe of risk and also to increase penetration into uncovered conventional risk across the region. We see growth opportunities across all the economies of Asia. The scale of the opportunity varies substantially from country to country and is due to a combination of factors including GDP growth, level of insurance penetration and the size of the population. Taking these factors into account China and Indonesia stand out with other Asian economies showing significant potential.”

The data for the guide has been collated from major rating agencies, regulators, industry associations, International Monetary Fund, World Bank, AXCO, Aon Risk Solutions, Aon Hewitt and Aon Benfield. In addition, the guide includes Aon Benfield’s own views of each market’s major risks, regulatory updates and market outlook.

Download the report:

|