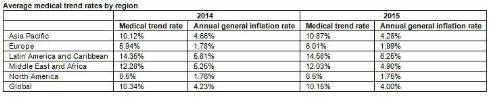

Aon Hewitt's report reflects the medical trend expectations of employer-sponsored medical plans in 84 countries based on reported data from Aon professionals, clients and carriers represented in the portfolio of Aon medical plan business in each country. The report shows that in 2015, medical costs are expected to increase by 10.15 percent before plan design changes and vendor negotiations—6 percentage points higher than the average inflation rate. In 2014, the global average medical trend was 10.34 percent. While the global average medical trend is expected to decline, three regions--Asia Pacific, Europe and Latin America--are projected to see an uptick in rates for 2015.

"There are three fundamental factors driving what is now a long-established pattern of high medical plan cost increases for multinational companies, including ever increasing utilization of private medical plans—especially in emerging markets—the aging of the world population and a higher incidence of chronic conditions for the working population," said Wil Gaitan, senior vice president of Global Benefits at Aon Hewitt. "The problem goes far beyond the financials of medical plans— absenteeism due to these factors is resulting in mounting losses in output levels and drains in employee productivity."

Global Factors Driving Health Care Claims

Aon Hewitt's report shows that cardiovascular issues (76 percent), cancer (60 percent) and diabetes (48 percent) were the most prevalent factors driving health care claims around the world. There were, however, a few notable differences by geographic region. Canada, for example, reported a higher prevalence of claims related to mental health issues, while Middle East/Africa reported more cases of high blood pressure.

The global risk factors that are expected to drive future claims—and contribute to the adverse experience driving high medical inflation—included high blood pressure (60 percent), poor stress management (52 percent) and high cholesterol (48 percent). Asia Pacific and Europe also cited poor stress management as a global risk factor, while Canada and Latin America noted obesity.

"As learned from the US experience, standard cost-management approaches will be insufficient to addressing anticipated future spiraling medical costs," added Gaitan. "It is crucial for employers to ensure that effective health care benefits and health care education are available for all employees and their families, aimed at preventing illness and better managing chronic conditions, providing high quality health care treatment, and encouraging the global workforce to adopt healthy behaviors. Maintaining a healthy workforce will not only be the way to arrest steep medical cost increases, but also a business imperative for long-term success."

|