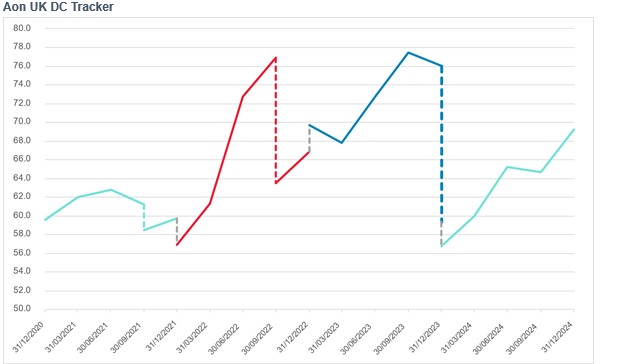

Over Q4 2024, the Aon UK DC Tracker rose which suggested that the expected future living standard in retirement provided by defined contribution (DC) savings was higher than at the end of the previous quarter.

All our sample savers saw their expected retirement income increase through a combination of strong benchmark investment returns over the quarter and an increase in expected return assumptions post-retirement.

Source: Aon UK DC Pension Tracker (1 October to 31 December 2024)

Over the quarter (October to December 2024) the Tracker rose from 64.6 to 69.2. This rise was driven by an increase in expected future returns post-retirement, and positive actual investment performance, particularly in equity markets.

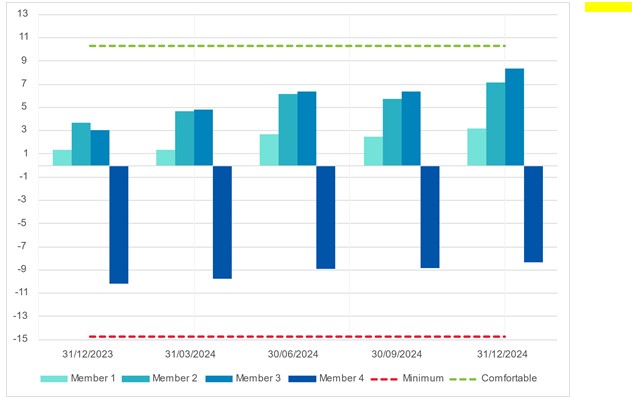

Savers’ Positions (measured compared to the ‘moderate’ living standard)

Source: Aon UK DC Pension Tracker (1 October to 31 December 2024)

Solid year for DC savings, but updated living standards to come

Over the whole of 2024, the Aon UK DC Tracker increased from 56.8 to 69.2 - an increase of around 20 percent. In £ terms, members expected retirement income increased over the year by between £2,000 and £6,000 per year. One contributing factor to this was the April increase in the State Pension (£900 p.a.) which benefited all members.

However, even with this substantial increase, the Tracker is yet to return to the level it reached prior to the 2023 update to the PLSA living standards.

Matthew Arends, partner and head of UK Retirement Policy at Aon, said: “Given inflation over the year, the expected increase in the PLSA’s retirement living standards when they are next reviewed will cause the Aon UK DC Tracker to fall to some degree. However, in the absence of any major update to the living standards, this impact may be more muted than in the previous two updates. Of course, in reality, DC savers are affected by actual levels of inflation in the prices of the goods and services they purchase daily.”

Following the calendar year-end - and as per our usual approach - all the sample savers will be re-set to their start-year ages and fund values for the next quarterly update.

National Insurance increase – positive for pensions?

In the November Budget, the Chancellor announced that an increase in employer National Insurance Contributions (NICs) would come into effect from April 2025. While this will ultimately increase staff costs for businesses, employee pension contributions made via ‘salary sacrifice’, which attract neither employee nor employer NICs, will become even more tax-efficient.

Matthew Arends, partner and head of UK Retirement Policy at Aon, said: “The changes to employer NICs on earnings will make it more attractive for employers to set up salary sacrifice and bonus sacrifice arrangements, benefiting employers and employees alike by reducing NIC costs and increasing employee take-home pay. In addition, employers who offer ‘cash-in-lieu’ of pension contributions – perhaps for those affected by the Annual Allowance – are likely to need to review their terms. Many employers offering these terms make a deduction for the employer NICs payable on the cash sum and this will need to be updated for the new NIC rate.”

Movement over the final quarter of 2024

The increase in the Aon UK DC Pension Tracker over the last quarter of 2024 was primarily driven by an increase in expected future return assumptions post-retirement and positive investment performance over the quarter.

• The youngest saver’s expected income increased by around £770 p.a. (2.2 percent), driven by positive investment performance and an increase in future expected return assumptions post-retirement. This was partially offset by a decrease in expected future investment return assumptions before retirement and lower expected salary increases over their working life.

• The 40-year-old saver saw an increase of around £1,615 p.a. (or 4.3 percent) in their expected retirement income. This was again driven by an increase in the expected future investment return assumptions post-retirement and the actual investment performance over the quarter, offset by falls in the expected future investment returns before retirement.

• Our 50-year-old saver saw the largest increase of around £2,240 p.a. (or 5.8 percent) in their expected retirement income. Due to this saver’s larger existing funds, they benefited the most from the positive investment returns over the quarter, with increases to expected post-retirement investment returns also benefiting this saver.

• The oldest savers saw an increase of around £600 p.a. (around 2.8 percent). This saver benefited from an increase to post-retirement expected return assumptions together with strong investment performance over the period. As this saver is close to retirement, they also benefited from an increase in their expected investment returns pre-retirement due to their higher allocation to bond assets (on which expected returns increased). This more than offset a reduction in the expected future returns on equity assets.

• Overall, the oldest saver is expected to be the worst off in retirement, albeit with a retirement income of around 150 percent of the ‘minimum’ Retirement Living Standard. This excludes any defined benefit pension benefits they may have but which are not included in this projection.

|