Matthew Arends, partner and head of UK retirement policy at Aon said: “This period’s Aon UK DC Pension Tracker shows that older savers were detrimentally affected by poor actual returns over the quarter. By contrast, the actual returns for younger savers were relatively strong but it was this group that was the most impacted by falls in expected future returns.

“However, all members benefited from the increase in the State Pension that was implemented from April This more than compensated for the negative factors, meaning that each of our savers had a higher score at the end of the quarter.”

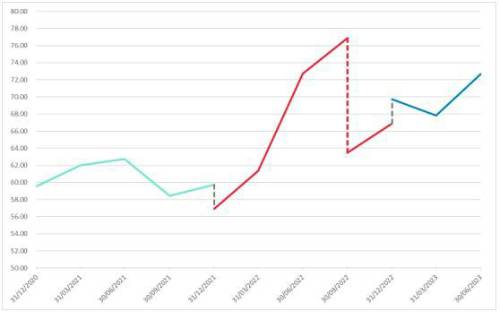

Aon DC Tracker

Source: Aon UK DC Pension Tracker (1 March to 30 June 2023)

As a reminder, in January 2023, the Pensions and Lifetime Savings Association (PLSA) released the latest inflation update to its Retirement Living Standards. The Q1 2023 release of the Aon UK DC Tracker showed that scores fell significantly after being restated to reflect these updates, as shown on 30 September 2022.

Over the quarter (March to June 2023), the Aon UK DC Pension Tracker rose from 69.7 to 72.7. Much of this increase was driven by the increase in the State Pension payable from April 2023, although older savers are also expected to receive more from their personal pension saving than at the start of the quarter.

Younger members are expected to receive less from their personal pension saving compared to the start of the period due to a reduction in expected future returns. However, this was partially offset by strong benchmark investment returns over the quarter in growth assets.

The results suggest that our savers are, on average, expected to have a higher standard of living in retirement than was expected at the end of the previous quarter.

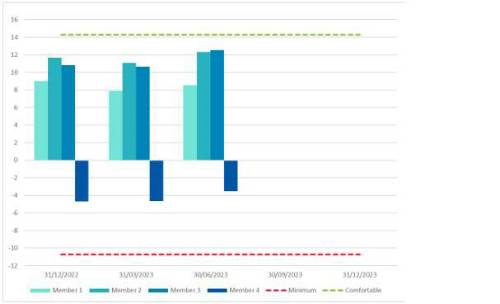

Savers’ Positions

Source: Aon UK DC Pension Tracker (1 March to 30 June 2023)

State Pension increases partially shield savers from the effects of inflation

While the stubbornly high levels of inflation are providing a cost of living challenge, it is not all bad news from a pension perspective. The State Pension is uprated by the ‘triple lock’, increasing in April each year in line with Inflation, average earnings, or 2.5 per cent, whichever is higher. Due to the current levels of inflation, this led to an increase of £972 in April 2023. This increase not only benefits current pensioners but is then ‘baked in’ to the State Pension in future years, meaning future pensioners should also benefit from it.

At £10,600 p.a., the full State Pension, available to individuals with 35 years’ National Insurance contributions, is almost sufficient to provide the ‘minimum’ retirement living standard (calculated as requiring £12,800 p.a.. However, any individual looking to retire on more than the ‘minimum’ will be reliant on their own individual pension saving to provide this.

Matthew Arends said: “Higher levels of price inflation have fed through into our example savers’ projected retirement incomes via the triple lock indexation of the State Pension. This will be particularly relevant to savers on lower income levels for whom the State Pension will be most, or all, of their expected retirement income. However, savers must have 35 qualifying years of National Insurance contributions to receive the full State Pension. All savers can check their State Pension forecast at www.gov.uk/check-state-pension.”

Recent data also suggests that salaries are increasing more rapidly than in previous years. While not matching the current level of inflation, these salary increases will feed through into higher future pension contributions, helping to improve savers’ retirement incomes.

However, as noted in previous editions of the Aon UK DC Pension Tracker, individuals opting out, or reducing pension saving as a result of the cost of living squeeze, are likely to see a significant fall in their retirement income as a result.

Movement over the second quarter of the year

The increase in the Aon UK DC Pension Tracker over the second quarter of 2023 was primarily driven by an increase in the State Pension payable from April. Savers’ pots were also expected to provide a higher level of income in retirement than at the start of the quarter.

All our savers are now closer to achieving the ‘comfortable’ level of retirement living standard than they were at the start of the quarter:

• The youngest saver experienced the smallest increase in their expected income, of around £600 p.a. or 2 per cent. While they will benefit from the increase in the State Pension, their expected retirement income from their pension savings fell due to a decrease in expected future returns over the period until retirement. They did however benefit from strong benchmark returns on their assets over the quarter.

• The 40-year-old saver saw an increase in their expected retirement income of around £1,200 p.a. (or 3.5 per cent), again this was primarily driven by the increase in the State Pension. They also benefited from strong benchmark returns over the quarter and, as they are closer to retirement, were less effected by the reduction in expected future returns over the period until retirement.

• Savers closer to retirement saw a significant increase in their expected retirement income due to the combined effect of a higher State Pension and an increase in the income their pot is expected to provide in retirement. Together with the positive returns on their larger existing fund value meant the 50-year-old saver saw the largest £ amount increase in expected income over the quarter of around £1,850 p.a. (5.4 per cent) when compared with the start of the quarter.

• The oldest saver also saw a significant increase in their expected income - around £1,100 p.a. (5.8 per cent), as they are the closest to retirement and so are impacted the least by lower future expected returns, while also benefitting from the increase in State Pension and higher expected income in retirement from their existing pot.

• Overall, the oldest saver is expected to be the worst off in retirement, with a retirement income around two-thirds of the way between the updated minimum and moderate standards of living. This excludes any defined benefit pension benefits they may have but which are not included in this projection.

• The younger three savers are all currently expected to achieve an income well in excess of the moderate standard of living in retirement.

|