Matthew Arends, partner and head of UK retirement policy at Aon said: “This period’s Aon UK DC Pension Tracker shows that all savers are expected to be better off in retirement, due to higher expected returns, particularly when they start to access their savings. As with any DC pension saving these higher expected future returns are not guaranteed and may or may not occur in practice.

“Interestingly – and for the first time since the Aon UK DC Pension Tracker was introduced in 2021 -

our two middle-aged savers are now expected to all but achieve the comfortable retirement living standard.”

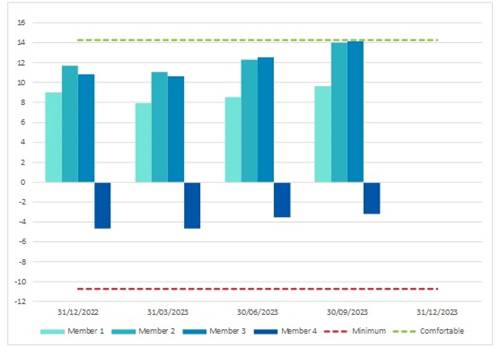

Aon DC Tracker

Source: Aon UK DC Pension Tracker (1 July to 30 September 2023)

As a reminder, in January 2023, the Pensions and Lifetime Savings Association (PLSA) released the latest inflation update to its Retirement Living Standards. The Q1 2023 release of the Aon UK DC Tracker showed that scores fell significantly after being restated to reflect these updates, as shown on 30 September 2022.

Over the quarter (July to September 2023), the Aon UK DC Pension Tracker rose from 72.7 to 77.5

All members are expected to receive more from their private pension saving compared to the start of the period due to an increase in expected future returns - particularly when they reach retirement and begin to access their savings. However, this was offset slightly by weak benchmark investment returns over the quarter, particularly in growth assets.

The results suggest that our savers are, on average, expected to have a higher standard of living in retirement than was expected at the end of the previous quarter.

Savers’ Positions

Source: Aon UK DC Pension Tracker (1 July to 30 September 2023)

Proposed auto-enrolment changes receive Royal Assent

The Private Member’s Bill, brought by Jonathan Gullis MP and Baroness Altmann, which expands the scope of auto-enrolment has now received Royal Assent, paving the way for its introduction as the Pensions (Extension of Automatic Enrolment) Act 2023.

The Act grants two extensions to auto-enrolment:

• Reducing the age at which employees are automatically enrolled from 22 to 18, and

• Abolishing the Lower Earnings limit for contributions meaning contributions would be paid from the first pound earned.

…and what this could mean…

For an 18-year-old entering the workforce now, the proposed changes could lead to an increase in their retirement income of around £6,250 a year, or an increase of around 27 percent, compared to the current system. As a much larger proportion of their income would become pensionable, the changes would be particularly beneficial to lower earning employees, including those working multiple part-time jobs. For a typical 18-year-old paying contributions for the first time, the cost could be around £55 per month from their take-home pay.

When added to the State Pension, the changes could mean that an average earner paying automatic enrolment minimum contribution rates is expected to achieve between “moderate” and “comfortable” standard of living in retirement as suggested by the PLSA/Loughborough University Retirement Living Standards. Without the proposed changes, the saver would be expected to receive less than the “moderate” standard of living in retirement.

If an 18-year-old increases their contributions above the minimum to a rate of 12 percent, the automatic-enrolment changes proposed could mean the average earner is expected to achieve the “comfortable” standard of living in retirement.

Matthew Arends said: “Clearly the effect of the changes to an individual’s retirement income is significant. However, it is important to note that these examples are based around the assumption of a complete (50 year) working life of contributions. In reality, many savers are likely to take career breaks or not work full time for the entire period. They may also choose to adjust their contribution levels based on their financial circumstances at any given point in time. While contributing 8 percent per year from 18 is a great place to start, it is important for savers to keep their pension savings under review and maximise their contributions where possible and affordable.

“Aon supports the changes in the Act and believes that it will lead to improved retirement outcomes – and particularly for the lowest paid employees. Many employers already provide contributions above the minimum level required by auto-enrolment. For them, the proposed changes may make little or no impact on the employees eligible, or on the contributions paid into their employees’ pension pots.”

Movement over the second quarter of the year

The increase in the Aon UK DC Pension Tracker over the third quarter of 2023 was primarily driven by an increase in expected asset returns for the different sample savers. In particular, savers’ pots were expected to provide a higher level of income in retirement, all else being equal, than at the start of the quarter.

All our savers are now closer to achieving the ‘comfortable’ level of retirement living standard than they were at the start of the quarter:

• The youngest saver saw an increase in their expected income, of around £1,000 p.a. or 3.4 percent. This was driven by a combined effect of an increase in post-retirement return assumptions and pre-retirement assumptions over the quarter.

• The 40-year-old saver saw the largest increase in their expected retirement income, at around £1,650 p.a. (or 4.7 percent), again this was primarily driven by an increase in the post-retirement return assumptions, although actual investment performance over the quarter detracted slightly from this increase.

• Savers closer to retirement also saw a significant increase in their expected retirement income, which saw the 50-year-old saver experiencing the second largest £ amount increase in expected income over the quarter of around £1,600 p.a. (4.5 percent) when compared with the start of the quarter. This was again driven by increases in pre-and-post retirement return assumptions, although relatively weak returns over the quarter were felt most by this saver, due to their larger existing fund value.

• The oldest saver also saw the smallest increase in their expected income - around £350 p.a. (1.8 per cent), as they are the closest to retirement and so benefit the least from higher future expected returns and were impacted by the relatively weak benchmark returns over the quarter.

• Overall, the oldest saver is expected to be the worst off in retirement, with a retirement income around 70 percent of the way between the updated minimum and moderate standards of living. This excludes any defined benefit pension benefits they may have but which are not included in this projection.

• The youngest saver is currently expected to achieve an income well in excess of the moderate standard of living in retirement. The latest update shows that the 40-year-old and 50-year-old savers are now expected to all but reach the comfortable standard of living in retirement when the state pension is taken into account.

|