• One in three UK SMEs cite online presence as key to growth

• Less than one in 10 perceive cyber attacks as a threat to business

• Seven percent of SMEs have taken out cyber insurance

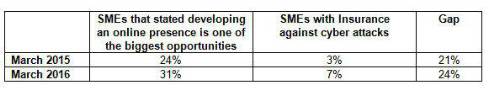

New research from Aon Risk Solutions tracked the responses from more than 1,000 SME decision makers across the UK. In March 2015, 24 percent of respondents saw online presence as key to their business when asked to pick the three biggest opportunities for their business in the year ahead, with 3 percent having cyber insurance – a gap of 21 percent. In March 2016, this gap increased to 24 percent, with 31 percent focusing on online expansion and 7 percent having cyber insurance.

At a time when the National Crime Agency has warned criminal cyber capability is outpacing the UK’s collective response, the SME community has an opportunity to increase preparation and the use of mitigation tactics. The Aon Risk study showed that nine percent of SMEs asked to pick the three biggest risks facing their business perceived cyber attacks as threats.

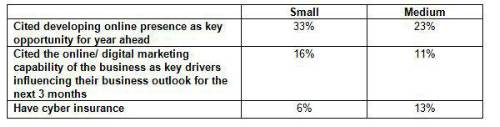

While the smallest businesses are significantly more likely to embrace internet-related business opportunities, the results of the survey indicated the smallest businesses are most at risk. Small businesses are more than twice as likely not to have cyber insurance as their medium-sized counterparts (6 percent compared with 13 percent).

Thirty-three percent of small businesses cited developing their online presence as a key opportunity area for their business for the year ahead, compared with 23 percent of medium sized business. Similarly, 16 percent of small businesses cited the online/ digital marketing capability of the business as important drivers influencing their business outlook for the next 3 months, compared with 11 percent of medium sized businesses.

Andrew Tunnicliffe, CEO, Aon Risk Solutions UK, commented: “Whilst the recent Brexit vote has drawn attention to Britain’s place in Europe, the business community in reality operates in a digitised, global marketplace where the pace of change is, at times, staggering. This reality is reflected in our latest study, with many SMEs placing greater emphasis on investing in online growth and opportunities.”

“Given this, it is a concern that 90 percent of SMEs have no cyber insurance in place, with many unnecessarily exposing their businesses to serious risks. At Aon, we are working hard to help SMEs anticipate and manage change in the face of an increasingly competitive market, it is important for SMEs to plan and navigate a clear path through uncertainty, managing risks before they damage their business.”

|