A distinct offering: Architas launches RDR-ready clean share classes across its three multi-asset fund ranges

Architas has today announced the launch of RDR-ready clean share classes across its multi-asset proposition that will be available across a number of platforms, including AXA Wealth’s award-winning platform Elevate.

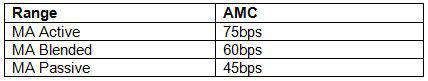

Architas is distinct in the market in that it offers three styles of multi-asset fund ranges: passive, active and blended, the latter of which was launched earlier this year. The clean share classes will be available across all 18 of these risk-profiled multi-asset funds plus three single-asset class funds* and will offer a choice of three different pricing models.

Importantly, Architas will maintain its commitment to cap total costs, referred to as OCF (on going charges figure), on the multi-asset passive range at 65bps for the new shares to maintain its competitive edge.

Hans Georgeson, managing director, Architas, said: “The race for RDR-ready multi manager propositions is well and truly on. Architas is agnostic on where a client chooses to invest; we are simply concerned with clear and simple charging. The new range of commission-free clean share classes offers increased transparency for both advisers and their clients, as part of our commitment to supporting advisers’ journey pre- and post-RDR.”

Advisers investing in the clean share classes before year-end will qualify for the popular 2012 Elevate loyalty offer, whereby the end client receives cash back, designed to be the equivalent of 100% of the Elevate portfolio charge for the lifetime of the investment in the Architas fund.

|