2009 to 2023 Report (1) and HMRC Private Pension Statistics (2), Emma Douglas, Director of Workplace Savings and Retirement at Aviva, said: “Pension saving appears to have passed one of its biggest tests since auto enrolment was introduced in 2012. Today’s official figures show no collapse in pension saving and no increase in ‘dash-for-cash’ withdrawals in 2023, despite pressures on household finances as inflation hit a four-decade high.

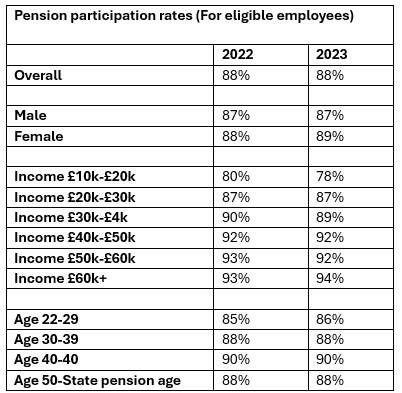

“Across all metrics, there has been no significant drop in pension participation since last year’s report. Different genders, ages and incomes have all shown remarkable resilience (Table 1). Pension participation is at an all-time high with 22.3 million employees saving for their retirement. Fewer than 1% of savers made the active choice to stop saving in the 2023, in line with previous years.

“The same resilience has been shown by those eligible to access their pension savings, from age 55. The average individual made taxable withdrawals of about £15,000 in 2023. This is in line with recent years. The average single withdrawal in 2023 was about £3,000. This is also in line with previous years. Today’s data shows no evidence of a systemic ‘dash for cash’.

“More people saving for their retirement is a good news story. And consideration when accessing these savings is also to be commended.

“It’s important that pensions continue to work for all savers and Aviva therefore welcomes the government’s plans to review the UK’s pensions and retirement market (3). We see this as an important next step and look forward to working with government and industry on the Review.”

(Table 1)

1. https://www.gov.uk/government/statistics/workplace-pension-participation-and-savings-trends-2009-to-2023/workplace-pension-participation-and-savings-trends-of-eligible-employees-2009-to-2023

2. https://www.gov.uk/government/statistics/personal-and-stakeholder-pensions-statistics

3. https://www.gov.uk/government/news/chancellor-vows-big-bang-on-growth-to-boost-investment-and-savings

|