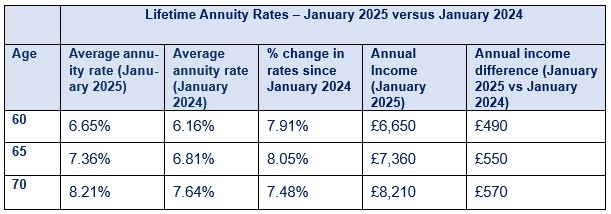

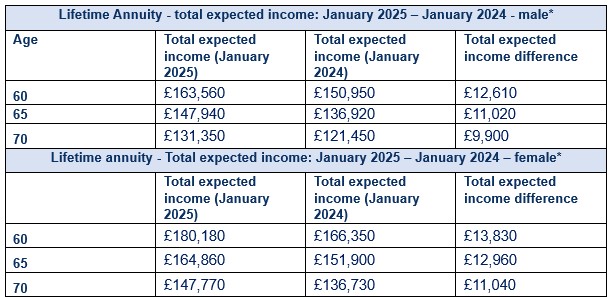

Annuity rates have increased by around 8% for a healthy 65-year-old over the last twelve months, according to the Standard Life Annuity Rates Tracker , adding £11,020 and £12,960 to the total lifetime income expected for a 65-year-old man and woman respectively.

This increase means that a healthy 65-year-old considering taking out an annuity now could expect to receive an annual income of £7,360, based on a £100,000 pension pot - an increase of £550 compared to January 2024.

About the Annuity Rates Tracker

About the Annuity Rates Tracker

The Tracker, developed by Standard Life, part of Phoenix Group, monitors current average annuity rates across the market for those annuitising at ages 60, 65, and 70. It also shows the total lifetime income from an annuity and the extent to which annuity rates improve with age, as well as the total income from a Fixed-term annuity.

Total lifetime income*

According to the Tracker, a healthy 65-year-old male who bought an annuity in January 2025 at a rate of 7.36% could expect a total lifetime income of £147,940. For a female of the same age, the expected income was £164,860.

Meanwhile, a healthy 70-year-old who bought an annuity in January 2025, could expect a rate of 8.21%. For a man, this would provide a total lifetime income of £131,350 while a woman could expect to receive £147,770.

*Total expected income figures are based on life expectancy statistics from the Office of National Statistics, based on age annuity is first purchased. Total expected income includes annuity income only.

Improving rates with age

Purchasing an annuity earlier in retirement typically results in higher overall income. However, annuity rates tend to increase with age, meaning those who choose to buy an annuity later in retirement are likely to benefit from better rates.

As of the end of January 2025, rates for a healthy 60-year-old were 6.65% compared to 8.21% for a healthy 70-year-old. This results in an annual income of £6,650 for a 60-year-old versus the £8,210 a healthy 70-year-old may expect to receive on a £100,000 pension pot – a difference of £1,560.

Fixed-term annuities

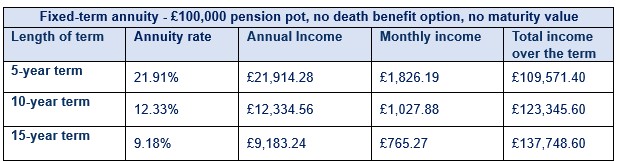

A fixed-term annuity provides a guaranteed income for a set period, allowing retirees the flexibility to reassess their option later. This can be particularly helpful for people looking to bridge any income gap between reducing their working hours or fully retiring before their State Pension payments begin.

The Standard Life Annuity Rates Tracker reveals that as of January 2025, the rates for a Fixed-term Annuity were 21.91% over a 5-year fixed term, 12.33% over a ten-year fixed term, and 9.18% over a 15-year fixed term.

A healthy 65-year-old, who bought a Fixed-term annuity in January 2025 with a £100,000 pension pot could expect a total income of £109,571 over a 5-year fixed term, £123,346 over a 10-year fixed term and £137,749 over a 15-year fixed term.

Pete Cowell, Head of Annuities at Standard Life, part of Phoenix Group, said: “Our latest Annuity Rates Tracker shows that annuity rates have continued to improve over the last twelve months and continue to offer retirees even stronger total incomes. Almost all (98%) people consider income security as an important factor when deciding what to do with their pension pot, and a similar amount (95%) prioritise certainty of income so it’s easy to understand why annuities are an increasingly popular choice. Providing peace of mind through a regular guaranteed income, the growing appeal of annuities is clear in the latest sales figures published by the Association of British Insurers (ABI) – increasing by 34% in a year.

“Looking ahead, we expect annuity rates, as well as the demand for these types of products, to remain strong, especially with pensions being brought into scope for inheritance tax from 2027. Wealthier savers may be encouraged to access more of their pensions, with annuities becoming an increasingly attractive way of doing so. It's also encouraging to see growing industry and adviser recognition on the flexible ways a guaranteed income can be incorporated into a broader decumulation strategy, using annuity products and options to create more tailored retirement journeys that meet specific needs in retirement.”

|