Aviva is urging people to take care with belongings when visiting the beach this summer, as the insurer reveals it deals with hundreds of beach-related claims each year.

Aviva data reveals it settled more than 1,700 personal belongings claims – an add-on to home contents cover - for items lost, damaged or stolen at beaches between 2016 and 2022.

The insurer’s 2022 claims data reveals that engagement or wedding rings topped the list of items lost or stolen at the beach last year, followed by watches and hearing aids. Other incidents included a necklace being lost in the sand, a camera being dropped on rocks and in one case, an engagement ring being lost in the sea - and eaten by a fish, according to the owner.

The data also reveals that freak waves are common causes for claims, including glasses being knocked off heads and rucksacks being swept out to sea.

A supporting survey of 2,000 UK adults, carried out by Aviva, also revealed three quarters (76%) of people plan to head to the beach this summer, raising the age-old question of how to keep personal belongings safe. This study revealed a third (33%) of people said they had lost a personal possession while at the beach or in the sea – although not all these items would have necessarily led to an insurance claim.

According to Aviva’s research, cash is the item most likely to go missing at the beach. Of those who said items had been lost, damaged or stolen at the seaside, nearly a third said money had been lost (32%) or stolen (33%). The items most likely to be reported damaged at the beach are mobile phones, with two fifths (39%) of respondents saying their device had suffered this fate, although damaged glasses were also common at 29% of people in this group. The same percentage (29%) revealed they’d had a bag stolen at the beach.

Buried treasure

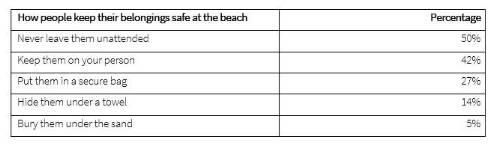

When asked how they protect their possessions at the beach, half (50%) of people surveyed said they’d never leave their belongings unattended. However, one in seven (14%) admitted to hiding their personal items under a towel, or even burying them in the sand or under rocks. According to Aviva’s survey, men are more likely to lose something at the beach with 40% of men admitting to losing items compared to just 25% of women.

To ensure treasured possessions are as safe as possible when heading to the beach, Aviva has the following tips:

1. Leave them at home - or secured at your hotel or accommodation: Most hotel rooms will be equipped with a safe, so take advantage of having a lighter beach bag and a sand-free phone by leaving valuables safely stored away for the day.

2. Get an anti-theft bag: If you have no other option than to take your valuables to the beach and don’t want to leave them unattended, it’s worth investing in an anti-theft bag. Most models lock, are slash-proof and can be fixed to an object like a sun lounger or chair.

3. Waterproof your things: Dry bags are waterproofed so you can keep your valuables on your person safely, while you swim.

4. List your valuables: If you have an item that’s worth more than the single item limit on your personal belongings cover – often around £2,000 – make sure the item is listed separately on your policy, to ensure it is adequately covered.

5. Avoid duplicating cover: Personal belongings insurance is a useful add-on to home insurance. But you may have cover for your belongings under ‘baggage’ cover within travel insurance, particularly if you’re going abroad. It’s best to check, to make sure a) that you’re covered and b) you’re not paying twice with add-ons under home and travel cover.

Kelly Whittington, Property Claims Director at Aviva says: “Trips to the beach are a holiday highlight, but it’s important to make sure you don’t end up losing more than a flip flop, or your hat in the wind. It can be tempting to leave items under a towel while we take a dip, but sadly we’ve seen that light-fingered visitors sometimes operate at the beach. And with all the sand, rocks and water, we know that damage can occur all too easily if items get buried or dropped.

“The best way to protect valuable items is to leave them at home, but this isn’t always practical, particularly if it’s an item you keep with you all the time, such as an engagement ring or phone. Personal belongings cover- an add-on to home insurance - can be a good option for people who want to protect their belongings when away from home. And because items can be covered anywhere in the world, they would be protected whether you’re on a UK beach or a more tropical destination. Hopefully beach-bound incidents will be few and far between this summer, but cover can provide peace of mind so you can relax as you soak up the sun.”

|