Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group, said: “While Rishi Sunak fell short of committing to include the Triple Lock in the Conservative Party manifesto this week, he confirmed it remains Government policy and it would be a huge shock if that were to change ahead of April 2024. With inflation widely forecast to continue to fall as we move towards the end of this year and into 2024, it seems almost certain that today’s earnings figure will be the decider and the new State Pension will rise to £11,501 in the Spring.

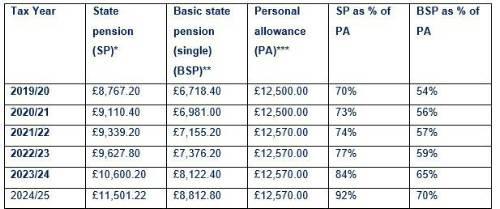

“After the sharp cost of living increases we’ve seen over the past couple of years the rise will come as a welcome boost to many, however it’s worth considering the possible tax implications for pensioners. The Personal Allowance, which is the amount of income you can receive before paying tax, has been frozen since 2021/2022 and currently remains fixed in for quite a few years to come. This means that the full State Pension payment has grown from 70% of the allowance in 2019/20 to a likely 92% next year, leaving pensioners with only £1,069 of headroom before they begin paying income tax.”

State Pension and Personal Allowance

Source – *Full state pension; **Basic state pension rates; ***Personal allowance figures

“An income at or just above the level of the Personal Allowance of £12,570 is below the Pensions and Lifetime Savings Association (PLSA)'s estimate for a mininum standard of living in retirement and people in this situation might be struggling financially, even before any tax liability. It’s worth anyone finding it difficult to get by each month checking what state benefits they might be entitled to – a good first port of call is to visit the benefits calculators page on the government website GOV.UK.”

|