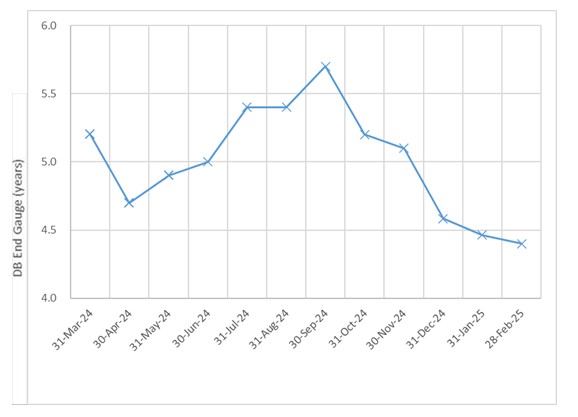

Barnett Waddingham (BW), has shared its latest analysis of the DB End Gauge index showing that the average time to buyout for FTSE350 DB pension schemes has decreased slightly over the month to 28 February 2025.

Lewys Curteis, Principal at consultancy Barnett Waddingham says: “BW’s DB End Gauge index decreased slightly over February. While bond and swap yields remained relatively stable, funding positions improved due to a reduction in long-term inflation expectations, which offset the weak performance of growth assets over the month.

"The start of March has seen geopolitical uncertainty continue to rise, with the imposition of substantial US trade tariffs weighing on investor confidence. Financial markets have reacted to this uncertainty, with significant falls seen in global equity markets and global bond yields pushing upwards. The impact for individual pension schemes will depend on their underlying investment strategies and the level of resilience built in to deal with market fluctuations. Trustees and companies should ensure the appropriate measures are in place to monitor the impact of financial market changes and, where necessary, review the level of risk being taken to ensure this is in line with risk appetites.”

You can follow the index here

|