The number of induced accidents (where fraudsters deliberately target innocent motorists to cause accidents in order to claim whiplash compensation) remained worryingly close to 2014’s record levels, dropping just 2% in 2015, according to figures from Aviva.

Conversely, the number of “staged” (when two damaged cars are brought together to make it look like an accident) and bogus accidents detected by Aviva fell by 40%, as tougher fraud prevention tools at the point of sale have stopped fraudsters accessing Aviva’s products.

Motor fraud remains the largest source of fraud Aviva detects, representing 60% of all claims fraud with a value of £58m. One-in-nine whiplash claims submitted to Aviva is tainted by fraud, and Aviva has more than 17,000 suspicious whiplash claims under investigation, with 4,000 motor injury claims linked to known fraud rings.

Tom Gardiner, Head of Fraud, Aviva, said, “We remain very concerned that fraudsters continue to put their own greed ahead of innocent motorists’ safety. Our figures show induced accidents now account for nearly half of all organised motor fraud we detect.

“Crash for cash does not just push up premiums for genuine customers, it puts innocent motorists at risk. It is also a significant drain on scarce public resources such as ambulance, police and A&E time, all of which are wasted on these entirely bogus claims. The number of whiplash claims is a problem unique to the UK and needs urgent reform.

“We support the proposals outlined by the Chancellor in the Autumn Statement, which included Aviva’s call for removing compensation from minor, short-term injuries. We believe this will end the gravy train for fraudsters, and we have pledged to pass 100% of the savings from the reforms on to our customers.”

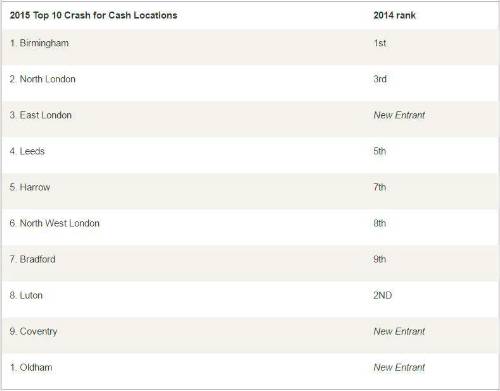

Regional Hotspots

Birmingham cemented its position as the nation’s crash for cash capital by increasing its share of these claims from 19% in 2014 to 25% last year. In fact, Aviva detected more induced accidents in Birmingham than the rest of the ‘Top 10’ locations combined.

NB: Manchester, Slough and Uxbridge featured in Aviva’s 2014 Top 10 hotspots table, but have dropped out of the top 10 areas for crash for cash in 2015

Geographic ‘lowlights’

Elsewhere, the notable changes to the Top 10 were the rapid growth of crash for cash in East London, making it the third worst area in the UK (it did not feature in the top 10 locations in 2014) and the absence of Manchester and Slough, both of which featured in Aviva’s 2014 table. Manchester has long been associated with crash for cash, and its absence is good news for local motorists.

Aviva has analysed crash for cash volumes down to postcode level, revealing granular detail on the UK’s most affected areas, including a number of new locations which could point towards a pattern of migration for fraudsters.

The worst postcode in the country for induced accidents is B11, which, taken on its own, would rank as the third worst city in the UK for crash for cash, highlighting how concentrated the problem is in some parts of Birmingham. In fact, the top eight postcodes for crash for cash are all Birmingham postcodes. But Aviva’s detailed postcode examination also found problem pockets in areas not normally identified with crash for cash.

For example, WR5 (Worcester), CT9 (Margate) and LE3 (Leicester) all feature in the top postcodes for crash for cash. This could indicate that the problem is moving to new areas, and shows that crash for cash is not confined to merely a handful of locations.

Tom Gardiner continued, “Induced accidents remain a serious concern for all road users. However, as our figures show, we are getting better at detecting, declining and prosecuting these claims – but urgent reform is needed to remove the root cause of the problem, which is easy access to compensation and profits.

“We urge motorists to remain alert to induced accidents, especially in those areas where we know this is a problem.”

|