-

53% of businesses had prepared well in advance*, making their application two months or more before their staging date

-

12% of businesses made their application to Aviva after their staging month had passed, putting them at risk of a fine

-

48% of employers left setting up their workplace pension to the last minute** New figures from Aviva reveal the extent to which some employers are leaving their auto-enrolment obligations to the last minute – and the proportion which appear to be organised well in advance of staging.

Aviva will be releasing the figures on a quarterly basis, highlighting when companies complete the set up of their workplace pension. The figures will use Aviva’s own client data to provide a snapshot of how close SMEs (Small and Medium Enterprises) are getting to their staging dates now they are in the thick of auto-enrolment.

Figures from The Pensions Regulator (TPR) show that the number of employers failing to fulfil their auto-enrolment obligations is rising. In Q2 2016, TPR issued 861 fixed penalty notices – more than a quarter of the total handed out since July 2012***.

Andy Beswick, MD Business Solutions at Aviva, said: “We’ve decided to release these staging numbers on a regular basis to highlight the good, and perhaps not so good, practices which are happening as auto-enrolment encompasses more and more SMEs.

“Business owners have to face up to auto-enrolment and not bury their heads in the sand. I hope that by showing when our own clients are choosing to stage, we can encourage others to act and start planning earlier for their workplace pension obligations.

“We understand that, for a variety of reasons, some business owners will leave applying to the last minute or miss their staging date. The good news is that we can work with all companies regardless of whether they are planning auto-enrolment well in advance or have already missed their staging date. No matter where they are in their journey we can get them set up with a workplace pension quickly and efficiently. We also have a range of planning tools that can help employers prepare in advance so they are ready in plenty of time.”

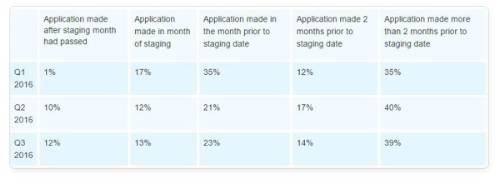

The table below details the proportion of workplace pension applicants to Aviva who applied in Q1, Q2 and Q3 2016 in comparison to their staging month. It shows a worrying trend with 12% of applications coming in after the company’s staging date in Q3 2016, up from only 1% in Q1.

“While 12% all companies who applied to us during Q3 did so after their staging month, in reality, almost half** of all businesses left their auto-enrolment obligations to the last minute,” said Andy Beswick. “Failing to set up a workplace pension before the staging date could result in fines and court action, but it doesn’t need to get that far.

“What’s really good to see is that more than half of our clients in Q3 completed their applications two months or more before their staging date.

“Planning ahead and getting a scheme set up early can help reduce the stress of working to a deadline and worrying about the consequences of missing the staging date.”

*Takes into account those who made an application with Aviva during Q3 2016 two months or more before their staging date

**Takes into account those who made an application with Aviva during Q3 2016 after their staging month had passed (12%), those who applied during the month of their staging date (13%) and those who applied in the month prior to their staging date (23%) = 48% (Figures have been rounded)

|