Over-75s are most at risk of being targeted by fraudsters, with 76% approached by email – exceeding the 69% who have been targeted by phone scams

Almost one in four (24%) over-75s say technology makes them feel vulnerable, while 43% feel it is not designed with their age group in mind

Despite their concerns, over-45s consider themselves ‘tech adopters’ with seven in ten (69%) willing to embrace new devices and technology

69% say technology has made their life easier, with the most positive impact felt on their day-to-day finances

More than one in four (28%) say they would have saved more for retirement if today’s technology had existed when they were younger, rising to 36% of 65-74s

With the Government currently consulting on a cold calling ban to “cut off a key source of pension scams”, the findings highlight the importance of also tackling digital security as the industry moves towards greater online management of people’s life savings following the widespread uptake of online banking services.

Aviva’s findings suggest almost three in four (73%) over-45s with internet access have been targeted by an email scam, equivalent to 20.61m people.[1] Of these, 6% or 1.24m people reported falling victim to an online approach.

In comparison, 60% of over-45s – equivalent to almost 17m in total – have been targeted by fraudsters via phone calls, with 7% of those (1.19m) saying they were a victim of phone scammers.

With over 20m people targeted by email scams compared with 17m via phone, it means there is a 22% higher chance of over-45s being subject to an online approach rather than by phone. The widespread nature of email scams also means more people have been a victim of such approaches than of phone scammers.

Older generations are most at risk, with over-75s most likely to be targeted by fraudsters via email (76% vs. 73% of over-45s) as well as telephone (69% vs. 60% of over-45s). Over-75s are also most likely to have fallen into the trap of an email scam, with 8% of those targeted saying they were a victim, compared to 6% of over-45s.

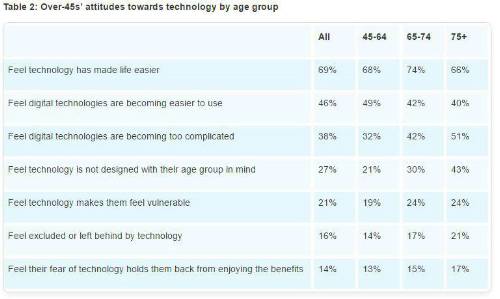

It therefore comes as no surprise that older age groups are most likely to feel more vulnerable as a result of the growing influence of digital technology in day-to-day life. Nearly one in four (24%) over-65s feel this way, along with nearly one in five (19%) of those aged 45-64.

Among all over-45s, nearly one in six (16%) feel excluded or left behind by technology, while 27% feel technology has not been designed with their age group in mind. One in seven (14%) feel their fear of technology holds them back from enjoying the benefits.

Most over-45s see themselves as ‘tech adopters’ but regret missing out financially

Aviva’s findings highlight that, despite these reservations, nearly seven in ten (69%) over-45s believe that technology has made their life easier, rising to three in four (74%) 65-74s. A similar majority of over-45s consider themselves to be ‘tech adopters’ – willing to embrace new devices and technology – including almost two in three (63%) who have passed the age of 75.

Overall, three in four (75%) over-45s feel technology has had a positive impact on their lives overall. Examining different aspects of living, the biggest positive impact is seen to have been on their day-to-day finances, where two in three (66%) report a positive effect.

Those who consider themselves ‘tech adopters’ show a greater confidence in their control over their day-to-day finances than non-adopters: 69% of adopters feel in control of their banking, compared with 51% of non-adopters.

In contrast, barely one in three over-45s (32%) feel technology has had a positive impact on their retirement finances with the majority (65%) reporting no impact at all. However, more than one in four (28%) over-45s feel they would have saved more for retirement if today’s technology had existed when they were younger, rising to over a third (36%) among 65-74s.

Rodney Prezeau, Managing Director, consumer Platform, Aviva UK Life, comments: “Our research dispels the myth that older generations are technophobes. However, it also highlights the security risks that come with lives that are increasingly led or supported by online services. The government is rightly taking action to combat the threat of pension cold-callers in later life, but it is important we don’t forget the additional threats that exist in the digital age.

“The fact that digital advances have had a welcome impact in so many areas of life has left many baby boomers feeling their retirement plans and savings habits would have benefitted from today’s technology. As we move pensions out of the Stone Age and make increasing use of online tools, it is vital we ensure that consumers are fully safeguarded and supported so more people are encouraged to engage with their savings.”

To view the Real Retirement report please click here |