Baby-boomers are enthusiastic users of technology, but pensions need to catch up

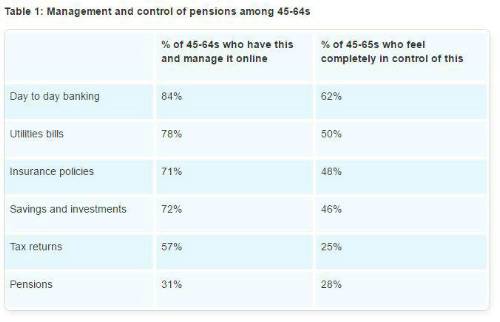

45-64s are clear users of technology when it comes to their day-to-day finances, with 84% managing their banking online

But 68% of 45-64s say technology is yet to have an impact on their retirement finances

Less than a third (28%) of 45-64s feel in complete control of their pensions, compared to 62% who are in full control of their day-to-day banking

Overall, a clear majority of over-45s (69%) are ‘tech adopters’ and willing to embrace new forms and devices

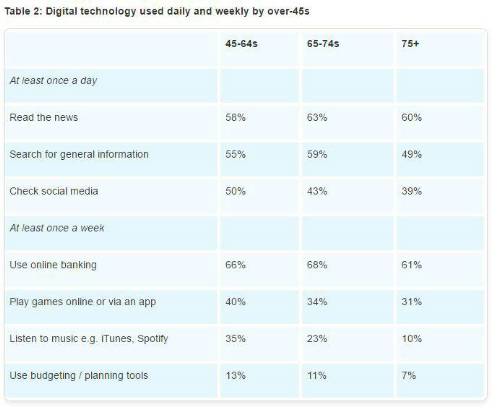

45-64s are also far more likely to use technology to play games (40%) each week than for budgeting and planning (13%)

Today’s over-45s are a tech savvy generation, with a clear majority (69%) describing themselves as ‘tech adopters’ who are willing to embrace new devices and technology, according to Aviva’s latest Real Retirement Report. As many as 63% of over-75s describe themselves as adopters, dispelling the myth that older people and digital innovation don’t mix.

Yet when it comes to retirement finances, technology has made little impact, although the industry is beginning to embrace digital innovation. Aviva’s online survey of over-45s with access to the internet found more than two in three (67%) 45-64s on the road to retirement agree technology has had a positive impact on their day-to-day financial planning, but when it comes to pensions, only 29% can say the same.

Just 31% of 45-64s currently manage their pension online. However, this age group are committed users of technology across other areas of financial management, with day-to-day banking (84%), utilities bills (78%) and savings and investments (72%) the most popular aspects that are managed online1. This holds true even among older age groups, with 85% of 65-74s and 80% of over-75s managing their banking online, highlighting the opportunity that exists to help more pensions savers maximise the benefit technology can offer when it comes to retirement planning.

Overall, 45-64s are more than twice as likely to say technology is important in helping them to manage their money (67%) as it is in managing their social life (32%).

Rodney Prezeau, Managing Director, Consumer Platform, Aviva UK Life comments: “We’ve long recognised that pensions have been stuck in the Stone Age when it comes to technological innovation, but the industry is increasingly waking up to this fact and taking active steps to improve digital services.

“At Aviva we’re implementing a Digital First strategy as we are committed to helping more of our customers manage their finances online, for example through our MyAviva service. We’ve also signed up to support the Government’s Pensions Dashboard initiative and are committed to playing a lead role in making it a reality2. There is still much more that can be done but it’s important that efforts continue to focus on providing these types of online services. There is a huge opportunity to help savers.”

Less than one in three 45-64s feel in complete control of their pensions

People approaching retirement are not only less likely to feel their retirement finances have been impacted by technology: they are also noticeably less likely to feel in control of their pensions than other areas of their other finances.

Less than a third (28%) of 45-64s say they feel in complete control of their pensions, compared to 62% who say the same of their day-to day-banking. Aviva’s analysis suggests the aspects of finances which people generally feel more in control of are also those that are more often managed online.

In a sign that technology does have the potential to help people manage their retirement finances better, 45-64s who describe themselves as tech adopters are more likely to feel in complete control of their pension (38%) than ‘non-adopters’ who are reluctant to do so (29%).

Half of 45-64s check their social media profiles at least once a day

Over-45s are daily consumers of technology, with almost three in five (58%) 45-64s in Aviva’s internet-enabled sample going online to read the news at least once a day, while 55% search for general information and 50% check social media. The popularity of social media is maintained even among older age groups, with 39% of over-75s checking their profiles at least once a day.

On a weekly basis, two in three (66%) 45-64s make use of online banking. However only 13% make use of technology for budgeting purposes over the course of a week. Meanwhile 40% of 45-64s play games online or via an app at least once a week, with this falling only slightly to 31% of over-75s.

More than a third (35%) of 45-64s listen to music through services like iTunes or Spotify once a week, while 20% stream films or TV shows.

Rodney Prezeau, Managing Director, Consumer Platform, Aviva UK Life comments: “Far from struggling to get to grips with technology, over-45s are using tech to enhance many areas of their lives, from catching up on the daily news to entertainment. Technology is great for having fun, but it can also be used to improve the more serious side of life too, like financial planning. It is more important than ever that people are saving for their retirement, and an important part of this is making sure savers have access to technology that enables a greater sense of control over their retirement finances and helps them get to grips with this aspect of financial planning.”

|