1 in 7 (14%) of businesses applying to Aviva for a workplace pension made their application after their staging date had passed

More than a third of businesses (38%) left their application to the last minute*

Just under half of companies (48%) prepared for auto-enrolment well in advance**

Around 500,000 UK businesses are due to set up a pension scheme during 2017 under auto-enrolment legislation.

However, Aviva’s own client data, from its second auto-enrolment application tracker, shows that during Q4 of 2016, 1 in 7 companies that applied to set up their pension with Aviva had missed their staging date – the date by which they should have had a workplace pension scheme in place, which is set by The Pension Regulator (TPR).

In a worrying trend, the proportion of firms applying with Aviva that missed their staging date has increased rapidly during the course of 2016, from just 1% in Q1 to 14% in Q4. However, during this time the volume of companies setting up workplace pensions has also increased offering some explanation for the rapid growth of ‘late stagers’.

Figures from The Pensions Regulator show that the number of employers failing to fulfil their auto-enrolment duties is rising.

In Q3 2016, 3,728 fixed penalty notices for £400 each were issued***. This is up from just 861 in Q2, 2016****.

Andy Beswick, Managing Director of Business Solutions at Aviva, said: “We’re seeing more and more firms applying to Aviva for a workplace pension after their staging date has passed. It’s something we need to keep a close watch on, but, it is understandable. Auto-enrolment is now becoming a reality for very small companies which have many priorities and not necessarily the resources to deal with them all.

“We understand this and we’re doing all we can to help these companies. We can help those companies that have missed their deadline and we’ve set up a simple online process to get a workplace pension in place.

“The last thing anybody wants is to see small business owners getting fined because they haven’t got their workplace pension set up in time.”

2016 in numbers

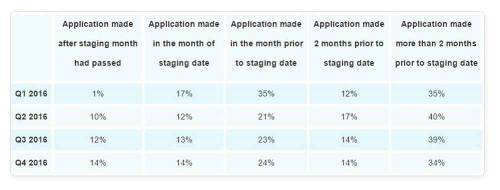

The table below details the proportion of workplace pension applicants to Aviva who applied in Q1, Q2, Q3 and Q4 2016 in comparison to their staging month.

While the number of companies missing their staging date has been increasing, the number of firms preparing for auto-enrolment two months or more in advance is staying relatively stable (47% - 57%).

“It is good to see that around half of all companies we are dealing with are preparing for auto-enrolment well in advance,” said Andy Beswick. “The decision of which provider to use for a workplace pension shouldn’t be rushed so dealing with it well in advance of the staging date can be an advantage.

“The message to businesses for 2017 is clear. If you haven’t been through auto-enrolment yet, this is likely to be your year. Don’t stick your head in the sand. Embrace it, find a way to use it as an advantage to your business and get your employees enthused about saving for their future.”

|