Research comes as older generation reveal top 10 bucket list travel experiences, with the high altitudes of Peru’s Machu Picchu topping the list

However, with almost a quarter (24%) of those aged 55 and over never buying travel insurance, latest data from Co-op Insurance highlights financial risk to travellers this festive season with average travel insurance claim of £426

With as many as five million Brits looking to head abroad over the festive period, new research from Co-op Insurance reveals there might be some presents missing from under the Christmas tree this year!

The research shows almost a third (29%) of the nation’s over 55’s choosing travel as most valued when considering how they spend their money, with Britain’s boomer generation prioritising living life to the fullest, as just over a tenth (13%) are choosing to spend on their children, and only a fifth (18%) splurging on their grandchildren.

And as the year ends, with many Brits looking ahead and setting their travel goals for 2024, the nation’s over 55’s have shown age doesn’t mean slowing down, as the research – conducted by YouGov on behalf of Co-op – shows a rather action-packed and far-flung list of ‘bucket list’ travel experiences that Britain’s boomers wish to accomplish.

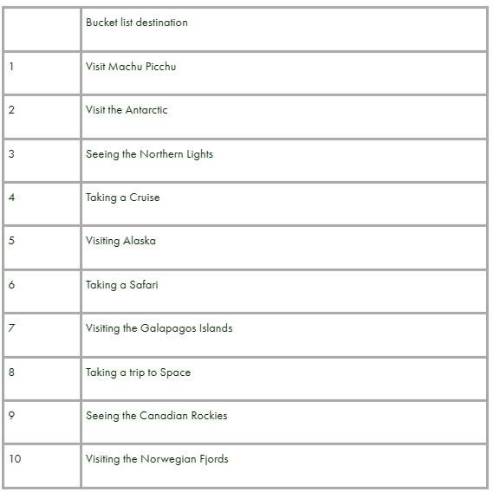

Top 10 ‘Bucket list’ travel experiences for the over 55’s

The high-altitude heights of Peru’s Machu Piccu came out on top as the number one destination for the over 55’s, whilst visiting the Antarctic, and seeing the Northern Lights, round out the top three travel experiences on their ‘bucket list’ – a term used to refer to a list of experiences or achievements a person hopes to have or accomplish during their lifetime.

And alongside visiting landmarks such as the volcanic Galapagos Islands or seeing the Canadian Rocky Mountains, the UK’s over 55’s also have some ‘out-of-this-world' bucket list aspirations, with a trip into space even making its way into the top ten.

However, with a dream list spanning across the globe, when it comes to planning for the unexpected, almost a quarter (24%) of the UK’s over 55’s said they never buy travel insurance when going on holiday, with almost a fifth (19%) of those citing their age (11%) or having pre-existing medical conditions (12%) as the reasons why they believe they would be unable to get cover.

But with the latest claims data from Co-op Insurance showing the average travel insurance claim to be £426, and some claims even reaching into the thousands, travellers could be at risk of a blue Christmas with high out-of-pocket expenses should they encounter any issues whilst away.

Graham Ward-Lush, Head of travel at Co-op Insurance, says: “As the dark nights draw in, and we make our way through the colder months, we know that many people will be looking to escape the UK’s wet weather for a winter break.

“And as our research shows, age doesn’t need to be a factor in stopping people from accomplishing those all-important travel goals, whether that be visiting an exotic destination or a world-famous landmark.

“However, whilst everyone should indeed be able to live life to the fullest, it is important that people plan ahead and protect themselves with travel insurance should the unthinkable happen. As with travel, age also shouldn’t be a factor in preventing people from protecting themselves with travel insurance, meaning they can continue to tick off those bucket list experiences with peace of mind should they be faced with an unexpected medical issue whilst abroad.”

|