|

|

Suppose you are trying to build a portfolio from a proverbial blank sheet. You have worked out what returns you need, and what constraints you have, and you’re now looking to find the best assets for the job. Philosophically, you have two extreme approaches: Start with nothing and include assets which improve the portfolio. Start with everything and cut down unnecessary assets. There are very good reasons why it makes sense to do the first- the asset universe is so vast that the second is wildly impractical. |

BENEFITS OF DIVERSIFICATION

Theoretically, however, it’s quite valid- if an asset class offers meaningful diversification, is there a case that it should be a part of every portfolio where there are no explicit reasons to exclude it, rather than only part of those where there is an explicit reason to include it?

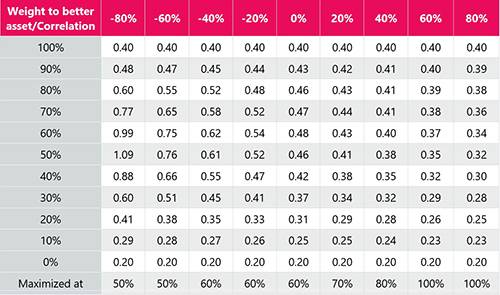

As a simple example, suppose there are only 2 assets available. Both are lognormally distributed with 10% volatility, but one has a 4% return and one has a 2% return. What Sharpe ratio do you get from different portfolios depends on the correlation between them, as shown below:

Even with a much lower return, the second asset still justifies a place in the portfolio unless it is highly correlated with the first. If the correlation is negative, even an asset with a negative return can improve the Sharpe ratio- a 20% allocation to a -1% return asset would improve the Sharpe ratio even when the higher returning asset had a Sharpe of 0.4.

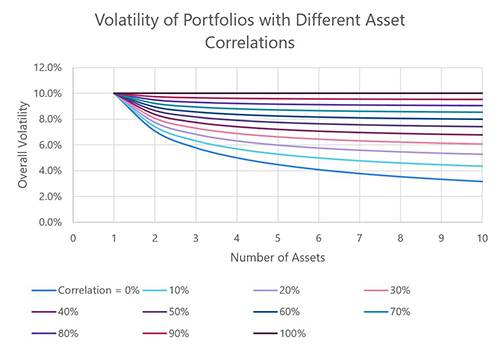

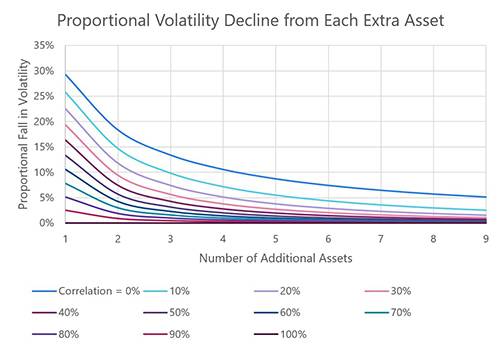

This benefit is somewhat limited- the marginal value of increasing diversification decreases, and it doesn’t take long to reach a point where the decline in diversification is within margin of error. This is especially true when the assets are reasonably positively correlated, which is increasingly likely as you add asset classes to a portfolio. The charts below show this effect for equal weighted portfolios with different numbers of assets at different correlations (each asset is assumed to have a 10% volatility).

In practice, there are a host of other considerations, not least governance, that will and should have a significant effect on portfolio construction. There are some cases where a portfolio should be concentrated- for example, if it is aiming to beat a benchmark, is part of a wider allocation, or is very small and constrained. However, as a rule of thumb, if there are fewer than 3-4 meaningfully different sources of returns in a portfolio, it may be worth looking at increasing diversification. |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.