Volatile investment markets and improving income rates have encouraged more retirees to consider annuities that pay a guaranteed income for life. But recent months have seen the gap between the most and least competitive annuity deals rise sharply, potentially resulting in savers spending more than necessary to secure the retirement income they need.

“Our analysis shows the best standard (non-personalised) annuity is currently delivering about 14% more secure income per pound of pension compared to the worst deal and many people would get even more once their medical history and lifestyle is taken into account,” said Stephen Lowe, group communications director at Just Group.

“The lower the cost of buying regular income, the more pension is left to use later. For every £1,000 of income required, the least competitive standard annuity for a healthy 65-year-old would use up about £17,450 of a pension pot, while the best would require £15,300 which is a saving of £2,150.

“Underwritten annuities reflecting medical conditions and lifestyle factors would be even better value. The exact investment required would depend on individual circumstances. As an example, someone classified as obese and taking medication for high blood pressure and high cholesterol would need to use about £14,500 of pension to secure £1,000 of lifetime income.”

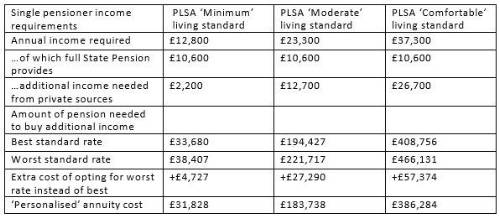

Recently updated Retirement Living Standards figures from the Pensions and Lifetime Savings Association1 help illustrate the extra cost of the worst compared to the best rates available. For a ‘moderate’ living standard, a single pensioner requires £23,300 a year income, of which £10,600 could come from a full State Pension, leaving a £12,700 shortfall.

Based on an analysis of recent rates*, a retiree seeking £12,700 a year extra income would pay:

• £221,717 if they opted for the worst standard annuity

• £194,427 by shopping around for the best standard annuity – a saving of £27,290

• £183,738 as an example of a ‘personalised’ annuity (assuming obesity and medication for high blood pressure and high cholesterol)

“For many people buying retirement income could be one of the largest and most important purchases they ever make so they should not accept the first deal on offer from their own pension provider,” said Stephen Lowe.

“Our figures show tens of thousands of pounds difference between the best and worst deals, money which could be saved or invested for the future or used to generate additional immediate income.”

Pension savers starting to think about how best to generate income from their retirement pots can receive professional support from a number of sources, helping them to understand their options and shop to find the most competitive deals.

• The government-backed Pension Wise service offers free, impartial and independent guidance.

• Specialist brokers can offer personalised guidance and advice on pension choices including gathering personal and health information and scouring the market for the best deal.

• Regulated financial advisers can offer initial and ongoing support and tailored retirement plans covering pensions, taxation and estate-planning.

“Retirement is a financially complex time of life, so it is a really good time to get some professional advice or guidance,” said Stephen Lowe. “Even small differences between income rates can add up to very large sums over the course of a long retirement.”

* Annuity returns were calculated based on a 65-year-old buying a single-life, level annuity with a 5-year guarantee period. Rates were correct on 4/1/2023. The ‘personalised’ annuity assumes the retiree is classified as obese and is taking medication for high blood pressure and high cholesterol.

|