Analysis of the Financial Conduct Authority’s Financial Lives Survey1 from leading independent consultancy Broadstone, reveals the lack of pension saver awareness of how their pension is invested and the charges they pay on it.

The figures come despite Broadstone modelling demonstrating how improved investment performance and lower charges add tens of thousands to people’s later-life savings enabling them to achieve a higher quality of living in retirement.

The FCA figures reveal that nearly a third (29%) of savers with at least one Defined Contribution (DC) pension said that they didn’t know that their pot was invested. When asked when they had last reviewed their pension investments, nearly four-fifths (78%) said they had never reviewed or don’t know whether they have.

On charges, over half of DC savers (55%) said that they were unaware that there were charges levied by schemes and, of these, 43% did not know how much they were being charged.

However, modelling from Broadstone reveals the difference that strong investment performance and low charges can make on a saver’s final pension pot.

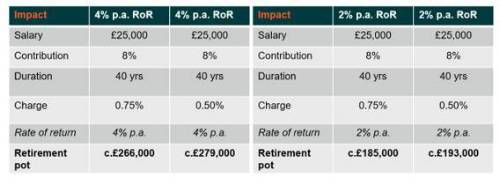

A worker earning £25,000 and with aggregate contributions of 8% would save around £185,000 over the course of a 40-year career – assuming investment performance of 2% and charges totalling 0.75%.

However, if investment performance improves to 4% the size of the pension pot rises to £266,000 – an increase of £81,000. A decrease in charge to 0.5% adds a further £13,000 taking the total pension savings to £279,000, nearly £100,000 more than the original pot.

Damon Hopkins, Head of DC Workplace Savings at Broadstone, commented: “Inertia funnelled millions more savers into the pension system and kickstarted these employees into making financial contributions towards their retirement.

“Yet, evidently we’re some way off ensuring people have adequate retirement savings in the current system. Many savers are blissfully unaware of how the performance of their pension investments and the charges that their scheme levy can impact their quality of living in retirement. Seemingly small differences in either could add up to significant differences in their overall pension savings.

“The Department for Work and Pensions is progressing its work on delivering better Value for Money for members and we are supportive of its efforts in this area. But, we need to encourage savers to engage with their pension and gain an understanding of both the charges they are paying and how their investment is performing. Not to mention, the possibility of putting more in!

“The Mansion House reforms set out lofty ambitions for DC investment yet if this doesn’t translate into improved retirement outcomes for savers, we risk devastating trust in the industry and letting down a whole generation of pension savers.”

|